Understanding Social Security Benefits

Social Security benefits provide financial support to eligible individuals, including retirees, disabled persons, survivors, and their dependents. The benefits are funded primarily through payroll taxes collected under the Federal Insurance Contributions Act (FICA) and the Self-Employed Contributions Act (SECA).

Who Benefits?

Retirees: The majority of Social Security recipients are retirees who qualify based on their work history. To receive full retirement benefits, individuals must meet specific age and earning requirements.

Disabled Individuals: The Social Security Disability Insurance (SSDI) program offers financial aid to people unable to work due to significant health conditions.

Survivors and Dependents: Families of deceased workers and dependent children also receive financial support through Social Security programs.

The Importance of Cost-of-Living Adjustments (COLA)

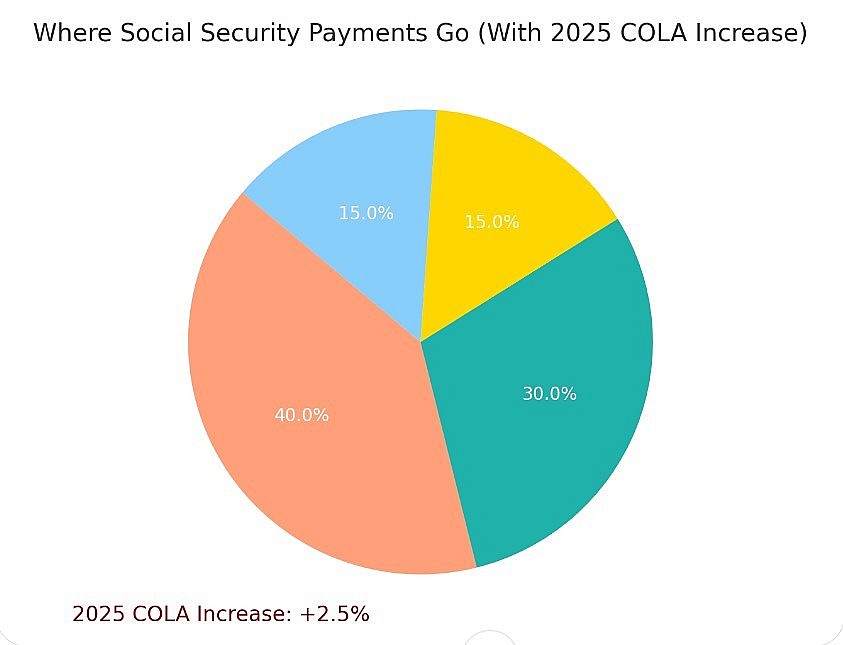

|

| It highlights major expense categories such as housing, healthcare, groceries, and other essentials, along with a note about the projected 2.5% COLA increase for 2025> Graphics: KnowInsiders |

The annual Cost-of-Living Adjustment (COLA) ensures that Social Security benefits keep pace with inflation. These adjustments are based on changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), calculated by the U.S. Bureau of Labor Statistics.

For 2025, the COLA is expected to result in a notable increase, reflecting higher living costs due to inflation. The upcoming adjustment is part of a broader effort to protect the purchasing power of retirees and other beneficiaries, ensuring they can maintain a reasonable standard of living.

How COLA Impacts Beneficiaries

Increased Monthly Payments: Beneficiaries will see an increase in their monthly Social Security checks, providing extra funds to cover essential expenses such as housing, healthcare, and food.

Economic Support for Seniors: Many seniors depend heavily on Social Security as their primary source of income. The increased payments are crucial for addressing rising expenses.

The 2025 Social Security Payment Increase

|

| COLA Adjustment. Graphics: KnowInsiders |

The upcoming increase in Social Security payments, effective January 2025, is part of the SSA's efforts to address inflation and support recipients amid economic uncertainties. While the exact percentage increase has not been formally approved, it is expected to significantly exceed previous years due to the persistent high inflation rates observed throughout 2024.

Key Details of the 2025 Increase

Effective Date: Payments reflecting the new increase will begin in January 2025.

Beneficiaries: Over 70 million Americans, including retirees, disabled individuals, and dependents, will benefit from the adjustment.

Economic Impact: The increase will inject billions of dollars into the economy, providing financial relief to households and contributing to overall economic stability.

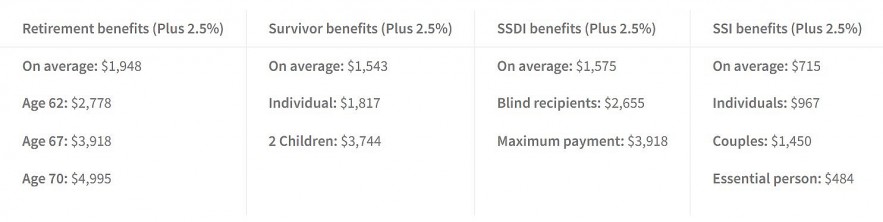

How Much Money Will Beneficiaries Earn with the New Increased Social Security Payment as of January 2025?

The exact amount Social Security beneficiaries will earn in 2025 depends on various factors, including age, work history, type of disability, and program eligibility. The Social Security Administration (SSA) determines monthly payments based on the beneficiary's unique situation. This includes factors such as lifetime earnings, years worked, and eligibility for specific programs like Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI).

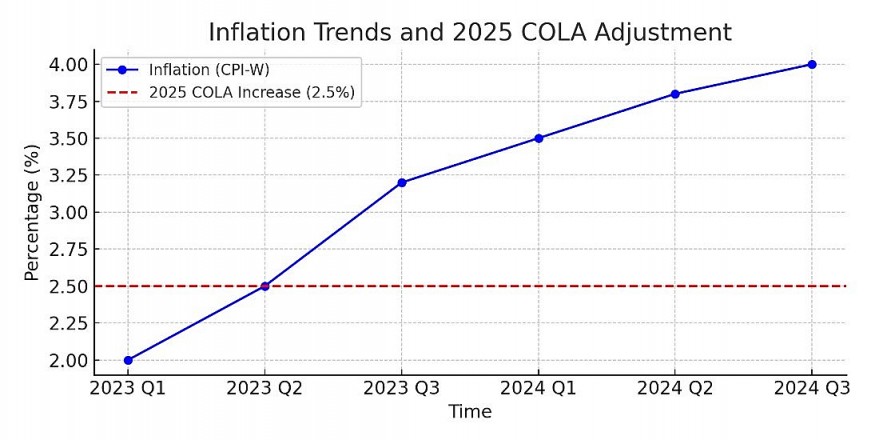

One key factor influencing the annual change in benefits is the Cost-of-Living Adjustment (COLA), designed to help recipients keep pace with inflation. For 2025, the SSA has announced a 2.5% COLA increase, which reflects inflation trends and rising consumer prices over the past year. This adjustment ensures that beneficiaries' purchasing power is preserved, especially as the costs of essentials like housing, healthcare, and food continue to climb.

Estimated Payments with the 2.5% COLA Increase

With the 2.5% boost in Social Security checks, beneficiaries across different programs will see higher monthly payments beginning in January 2025. Below are estimated examples of how the increase will affect different groups:

-

Retirees:

The average retired worker currently receives approximately $1,850 per month. With the 2.5% increase, they can expect an additional $46.25, raising their total to around $1,896.25 per month.

-

Disabled Workers (SSDI):

The average SSDI beneficiary receives about $1,483 per month. After the COLA adjustment, their payment will increase by $37.08, resulting in an average monthly payment of $1,520.08.

-

Survivors:

Survivor benefits, which assist families after the loss of a loved one, will also see an increase. A survivor receiving $1,500 per month would now earn $1,537.50.

-

Supplemental Security Income (SSI):

SSI beneficiaries, often those with limited income or resources, currently receive a maximum federal payment of $914 for individuals or $1,371 for couples. After the 2.5% increase, individuals will see an additional $22.85, raising their maximum monthly payment to $936.85. Couples will see an increase of $34.28, bringing their total to $1,405.28.

|

| Benefits |

Payment Schedule for January 2025

The Social Security Administration has released a tentative payment schedule for January 2025. Payments are typically distributed based on the beneficiary’s birthdate:

Birthdays on the 1st–10th: Payments issued on the second Wednesday of the month.

Birthdays on the 11th–20th: Payments issued on the third Wednesday of the month.

Birthdays on the 21st–31st: Payments issued on the fourth Wednesday of the month.

These schedules ensure timely and organized distribution, minimizing delays and allowing recipients to plan their budgets effectively.

Challenges and Considerations

While the 2025 payment increase is welcome news, several challenges remain:

Inflationary Pressures: Rising costs of goods and services may offset some of the benefits of the increase, leaving recipients with limited financial flexibility.

Healthcare Costs: With healthcare expenses continually climbing, many seniors may still struggle to afford adequate medical care despite higher payments.

Awareness and Accessibility: Ensuring that all eligible individuals are aware of the increase and understand how to access their benefits is critical for maximizing the program’s impact.

Financial Planning for Retirees

To make the most of the increased payments, retirees should consider:

Budgeting: Allocating funds for essential expenses and savings.

Seeking Financial Advice: Consulting with financial advisors to manage Social Security benefits effectively.

Exploring Additional Resources: Investigating supplementary programs, such as Medicare and Medicaid, for additional support.

Broader Implications of the Increase

The 2025 Social Security payment increase reflects the U.S. government’s commitment to supporting retirees and vulnerable populations. By adjusting benefits to meet rising living costs, the SSA reinforces the importance of Social Security as a cornerstone of retirement planning.

Strengthening the Economy

Increased payments are not just beneficial to recipients but also to the economy at large. Beneficiaries typically spend their Social Security income on essential goods and services, stimulating local economies and creating a ripple effect that supports businesses and employment.

Promoting Financial Security

For many Americans, Social Security is more than just a check; it is a lifeline that provides dignity and independence in retirement. The 2025 increase will play a vital role in enhancing financial security for millions of households.

Conclusion

The new Social Security payment increase scheduled for January 2025 is a crucial step toward ensuring that retirees and other beneficiaries can meet their financial needs in a challenging economic environment. With over 70 million Americans set to benefit, this adjustment underscores the importance of Social Security as a pillar of financial stability and economic resilience.

As beneficiaries prepare to receive their increased payments, it is essential to consider the broader impact of these changes on individuals, families, and the economy. While challenges remain, the upcoming adjustments provide a welcome boost to millions of households, reinforcing the vital role of Social Security in supporting America’s aging population.