Gold Fever 2025: Why Experts See $4,500 Ahead

As gold prices break new records in 2025, investors and analysts are watching closely: Is this the start of a new supercycle? With spot gold recently surpassing $3,240 per ounce, the global gold market is flashing strong bullish signals. What’s driving this surge, and where are prices headed next?

This article breaks down key drivers behind gold's rise, insights from leading financial institutions like Goldman Sachs and Bank of America, and what the future could hold for gold investors.

Read more: Gold Fever: Vietnam Discovers 52 New Gold Mines in 2025, Redrawing Global Mining Map

|

| Gold Fever Chaos. Image: KnowInsiders |

Gold Prices Hit Record Highs in 2025: What’s Behind the Rally?

The gold market in 2025 is being shaped by a powerful mix of global instability, aggressive monetary policies, and renewed investor appetite for safe-haven assets. Here's what’s fueling the climb:

1. Global Economic and Geopolitical Instability

From escalating U.S.-China trade tensions to ongoing conflict hotspots in Europe and the Middle East, geopolitical risk has become a central factor in gold’s momentum. New U.S. tariffs of up to 145% on Chinese imports have triggered fears of a broader trade war, driving investors toward gold’s historical role as a hedge against volatility.

2. Record-Breaking Central Bank Gold Demand

Central banks are quietly powering the gold rally. According to Goldman Sachs, monthly institutional gold demand in the London OTC market has surged over 500%, jumping from an average of 17 tonnes to 108 tonnes. Countries are increasing gold reserves to reduce exposure to the U.S. dollar and safeguard against currency risk.

3. Strong ETF Inflows and Retail Investment

Investment demand is booming. March alone saw $6 billion in net inflows into gold-backed ETFs in the U.S., according to the World Gold Council. Retail investors are following institutional money into gold as inflation fears persist and rate cuts loom on the horizon.

Read more: Top 10 Countries with the Largest Gold Reserves in the World 2025

Gold Price Forecast 2025: What the Experts Are Saying

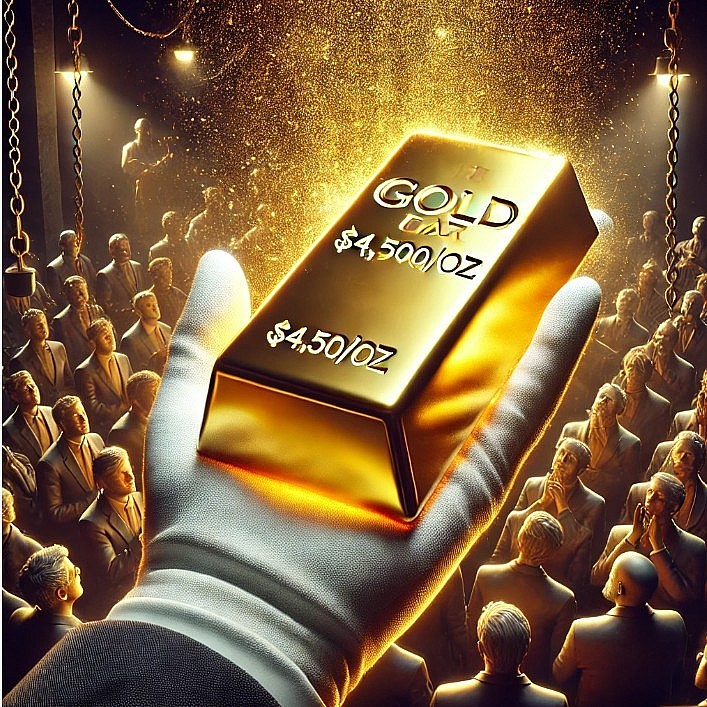

|

| Forecast or Fantasy? $4,500 Gold Is on the Table |

Goldman Sachs:

Raised its year-end gold price forecast to $3,700 per ounce, citing higher-than-expected central bank buying and ETF inflows. In a high-risk scenario, such as a deeper U.S.-China trade decoupling, gold could reach $4,500.

Bank of America:

Projects gold will average $3,063 in 2025, climbing to $3,350 in 2026. BofA sees continued strength driven by macro uncertainty and long-term inflationary pressure.

J.P. Morgan:

Forecasts gold to reach $2,600 by end-2025, assuming the Fed cuts rates later in the year. J.P. Morgan believes gold remains “structurally supported” by global demand trends.

World Gold Council:

Reports that 2024 was gold’s strongest performance in over a decade, with a 28% year-to-date rise. The council expects stable gains through 2025 as real yields fall and global growth slows.

Technical Outlook: Can Gold Hit $3,800 or More?

From a charting perspective, gold shows no signs of exhaustion. Analysts highlight support levels at $3,170 and $3,050, with upside targets around $3,380–3,800 in the medium term. Momentum indicators remain firmly bullish.

Is Now the Time to Buy Gold?

If you're considering adding gold to your portfolio, the 2025 outlook suggests it's far from too late. Between central bank demand, ETF inflows, and macroeconomic uncertainty, the fundamentals remain solid.

But as always, timing and strategy matter. Short-term pullbacks are possible, especially after sharp price spikes. Long-term investors may benefit from dollar-cost averaging into positions over time.

Conclusion: Gold’s Bull Market Looks Set to Continue

The gold price forecast for 2025 points to continued strength, supported by macro trends, institutional demand, and shifting geopolitical dynamics. Whether you're a seasoned investor or a cautious newcomer, gold remains one of the most compelling assets in today’s unpredictable economic landscape.

Investors Brace for $4,000 Gold: What’s Fueling the Dramatic Price Surge? Investors Brace for $4,000 Gold: What’s Fueling the Dramatic Price Surge? Gold Prices Poised to Skyrocket: Expert Forecasts Predict Record Highs of $3,500 to $4,000 per Ounce. |

Gold Price Retreats from Record Highs: What’s Next for the Precious Metal? Gold Price Retreats from Record Highs: What’s Next for the Precious Metal? After soaring above $3,100 per ounce, gold prices have pulled back sharply. Is this a temporary dip or the start of a broader correction? |

Gold Fever: Top 11 Largest Gold Mines in the World, By Production Gold Fever: Top 11 Largest Gold Mines in the World, By Production As of 2025, there are more than 1,300 active gold mines operating globally. But where exactly are the world’s most productive gold mines located today? |

Top 5 Largest Gold Mines in Vietnam: Reserves, Status, and Economic Impact Top 5 Largest Gold Mines in Vietnam: Reserves, Status, and Economic Impact Below is an expert-curated ranking of the Top 5 Largest Gold Mines in Vietnam—based on total reserves, historical output, and economic relevance—updated 2025. |