Tips to Maximize Social Security Benefits in 2025

|

| How to Maximize Social Security Benefits in 2025 |

Social Security provides critical financial support to millions of Americans, particularly retirees over the age of 65. According to Investopedia, nine out of ten retirees rely on Social Security for monthly payments, and close to half of these individuals depend on it as their sole source of income. However, with the average monthly benefit of $1,710.78 as of late 2023, many retirees find it challenging to cover essential expenses such as housing and healthcare. Rising costs have underscored the importance of maximizing Social Security benefits for a more secure financial future.

Understanding Social Security Benefits

To maximize Social Security, it’s essential to first understand how benefits are calculated. Your payment is determined by three main factors:

- Earnings History: The Social Security Administration (SSA) uses your 35 highest-earning years to calculate your average indexed monthly earnings (AIME).

- Full Retirement Age (FRA): This is the age when you’re eligible to receive 100% of your benefits. For those retiring in 2025, FRA will be 66 or 67, depending on your birth year.

- Claiming Age: You can begin benefits as early as 62, but your payments will be permanently reduced. Delaying benefits past FRA increases them through delayed retirement credits, which add approximately 8% per year until age 70.

Understanding these factors enables retirees and workers to develop personalized strategies for maximizing benefits.

How Upcoming Changes to US Retirement Age Impact Americans Over 50 How Upcoming Changes to US Retirement Age Impact Americans Over 50 |

Strategies to Maximize Benefits

1. Work for at Least 35 Years

The SSA bases your benefits on your 35 highest-earning years. If you work fewer than 35 years, zeros will be factored into the calculation for the missing years, reducing your average earnings and benefits. Continuing to work, even part-time, can replace lower-earning years with higher-income ones, thereby increasing your overall payment. This is especially critical for those who took career breaks or entered the workforce later in life.

2. Delay Claiming Benefits Until Age 70

Delaying Social Security past your FRA can significantly increase your monthly payment. For every year you delay, you earn an additional 8% through delayed retirement credits, up to age 70. For example:

- If your FRA benefit is $1,000 per month, delaying until age 70 would increase it to $1,320.

- Over a 20-year retirement, this delay could yield tens of thousands of dollars in additional income.

While this strategy isn’t suitable for everyone, particularly those with health issues or limited alternative income sources, it’s a powerful option for those who can afford to wait.

3. Optimize Spousal and Survivor Benefits

Social Security provides additional benefits for spouses and widows/widowers. Spousal benefits can amount to 50% of a higher-earning partner’s FRA benefit, while survivor benefits allow widows or widowers to claim up to 100% of their deceased spouse’s benefit. Coordinating these benefits effectively can significantly increase household income. For example:

- A lower-earning spouse might claim spousal benefits first and then switch to their own higher benefit later.

- Widows or widowers can claim survivor benefits before transitioning to their own higher benefit at age 70.

A financial advisor can help determine the optimal strategy for your unique situation.

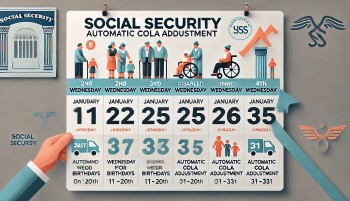

4. Take Advantage of Cost-of-Living Adjustments (COLA)

Each year, Social Security benefits are adjusted for inflation through a cost-of-living adjustment (COLA). In 2023, beneficiaries received an 8.7% COLA—the largest increase in decades. These automatic adjustments can significantly boost your monthly payments over time. Retirees should factor COLA increases into their long-term planning to maintain purchasing power amidst rising costs.

5. Continue Working After Claiming Benefits

If you claim Social Security but continue working, your earnings can replace lower-income years in your earnings record. The SSA recalculates your benefit annually to account for these updates, which could result in higher payments. However, if you claim benefits before FRA, your payments may be temporarily reduced if your earnings exceed the annual threshold. For 2025, this threshold is expected to be around $21,240, with $1 withheld for every $2 earned above the limit. Workers nearing FRA should weigh these trade-offs carefully.

2025 Social Security COLA: How All Benefits To Change and When Will the Payments Arrive 2025 Social Security COLA: How All Benefits To Change and When Will the Payments Arrive |

Considerations for 2025

The year 2025 brings several unique factors to consider when planning your Social Security strategy:

1. Rising Costs of Living

The average Social Security payment of $1,710.78 often falls short of covering basic needs, especially as housing, healthcare, and other living expenses continue to rise. Planning to supplement Social Security with other income sources—such as retirement savings or part-time work—can help bridge the gap.

2. Potential Legislative Changes

Social Security’s long-term solvency remains a topic of debate in Congress. Although no major changes are expected in 2025, workers and retirees should stay informed about potential updates to benefits or funding mechanisms.

3. Higher Taxable Wage Base

The taxable wage base—the maximum income subject to Social Security tax—is expected to increase in 2025. Workers earning above this threshold won’t pay additional Social Security taxes, but understanding how this affects your overall earnings and contributions is important for long-term planning.

4. Medicare Premiums

Social Security benefits are often reduced by Medicare Part B premiums, which are deducted automatically. Rising healthcare costs in 2025 could further impact retirees’ net benefits. Planning for these expenses is critical to avoid financial strain.

Universal Tips for Both Workers and Retirees

1. Minimize Taxes on Social Security

Depending on your combined income, up to 85% of your Social Security benefits may be subject to federal income tax. Strategies to reduce tax liability include:

- Spreading withdrawals from retirement accounts across multiple years to avoid crossing income thresholds.

- Converting traditional IRAs to Roth IRAs to minimize required minimum distributions (RMDs).

2. Consider Longevity in Your Planning

Social Security provides lifetime income, making it an essential component of retirement planning for those with long life expectancies. Delaying benefits can maximize your total payout if you expect to live beyond your mid-80s.

3. Consult a Financial Advisor

Navigating Social Security rules can be complex. A financial advisor can help you evaluate your options, optimize your claiming strategy, and integrate Social Security into your broader retirement plan.

Conclusion

Maximizing Social Security benefits requires a combination of informed decision-making, careful planning, and adaptability to changing circumstances. For retirees, strategies like leveraging COLA, optimizing spousal benefits, and working part-time can provide additional financial security. For workers, focusing on maximizing earnings, delaying benefits, and avoiding gaps in work history can significantly boost future payments.

As 2025 approaches, both groups must remain proactive in understanding the evolving landscape of Social Security. By implementing the strategies outlined in this article, you can ensure a more stable and secure financial future, no matter where you are in your retirement journey.

Beneficiaries, Payment Schedules for 2025 Social Security Increase Beneficiaries, Payment Schedules for 2025 Social Security Increase For millions of people, Social Security is an essential part of their financial security, and this impending increase emphasizes how important it is to ensuring ... |

2025 Social Security Payment: Key Dates and How to Get Faster 2025 Social Security Payment: Key Dates and How to Get Faster The United States Government has officially finalized the payment schedule for Social Security and other federal assistance programs, including VA (Veterans Affairs), SSI (Supplemental Security ... |

When Will the First COLA-Adjusted Payments Arrive in January 2025? When Will the First COLA-Adjusted Payments Arrive in January 2025? The Social Security Administration (SSA) implements annual Cost-of-Living Adjustments (COLA) to ensure that Social Security benefits keep up with inflation. For 2025, millions of beneficiaries ... |