Top 5 Crypto Exchanges in U.S. & Canada (2025 Updated Guide)

|

| Best Crypto Exchanges in U.S. And Canada |

Cryptocurrency investing in North America continues to evolve. With regulations tightening and innovation accelerating, picking the right exchange is mission-critical. You need a secure, user-friendly, legally compliant platform that offers competitive fees and the features you need.

This guide dives deep into the top 5 exchanges for U.S. and Canadian investors—complete with direct URLs, updated insights, pro tips, and clear advice.

1. Coinbase (U.S. & Canada)

-

Website: https://www.coinbase.com/

-

Overview: Coinbase is the most widely used beginner-friendly exchange in North America.

-

Security & Compliance: 98% of assets are stored offline; USD balances FDIC-insured; fully complies with U.S. (FINRA) and Canada (FINTRAC) regulations .

-

Fees:

-

Basic buys: 0.5–4.5% depending on payment method.

-

Coinbase Advanced Trade: 0.04–0.60% maker/taker.

-

Coinbase One subscription offers zero trading fees plus enhanced rewards at $29.99/month.

-

-

Assets & Features:

-

Offers 230+ crypto assets, staking options, learning rewards, and institutional-grade APIs.

-

-

User Tips:

-

Always enable 2FA and beware of phishing—Coinbase never initiates unsolicited calls.

-

Start with small purchases to unlock higher limits.

-

-

Ideal User: Beginners seeking a smooth UX and advanced traders wanting a bridge to higher-tier tools.

2. Kraken (U.S. & Canada)

-

Website: https://www.kraken.com/

-

Overview: Established in 2011. Known for security, compliance (bank charter in Wyoming), and advanced trading.

-

Security & Compliance: 95% cold storage, 2FA, regulated by FinCEN (U.S.) and FINTRAC (Canada) .

-

Fees:

-

Maker/taker: 0–0.26% depending on 30-day volume.

-

-

Assets & Tools:

-

200+ coins, margin up to 5×, futures trading, staking up to 17% APR, and OTC services.

-

-

User Tips:

-

Choose Kraken Pro for lower fees and charting tools.

-

Keep up with regulatory updates—Kraken recently settled with the SEC and CFTC.

-

-

Ideal User: Active or professional traders who want margin/futures and deep liquidity.

3. Gemini (U.S. & Select Canada)

-

Website: https://www.gemini.com/

-

Overview: Founded by the Winklevoss twins in 2014; regulated by NYDFS and fully insured.

-

Security & Compliance: U.S.-regulated with SOC certification and $200M hot wallet insurance.

-

Fees:

-

Standard platform: ~0.35% maker / 0.40% taker.

-

ActiveTrader Pro offers reduced fees.

-

-

Assets & Features:

-

70+ coins, staking, Gemini Earn, credit card with BTC rewards.

-

-

User Tips:

-

Watch for possible withdrawal delays—convertibles sometimes flagged due to compliance.

-

For Canadians, some features may be limited until full rollout.

-

-

Ideal User: Security-conscious U.S. investors wanting fully insured custody; Canadians testing the platform.

4. Binance.US (U.S.)

-

Website: https://www.binance.us/

-

Overview: U.S.-compliant offshoot of global Binance, offering professional-grade tools.

-

Security & Compliance: U.S.-based storage, standard security certifications; more limited fiat backing than competitors.

-

Fees:

-

Maker: 0.00–0.10%, Taker: 0.04–0.10%—industry-lowest .

-

-

Assets & Tools:

-

160+ cryptocurrencies; spot, staking, OTC, APIs.

-

-

User Tips:

-

Take advantage of high staking rewards on ETH, SOL, BNB.

-

Understand U.S. limitations—Binance.US only, Canadian users use third-party partners.

-

-

Ideal User: U.S. residents seeking the lowest fees and advanced trading features.

5. Bitbuy (Canada)

-

Website: https://bitbuy.ca/

-

Overview: Leading Canadian platform, fully regulated (CIRO, IIROC registration in progress).

-

Security & Compliance: Built for Canada—Interac e-Transfers, Canadian tax reporting, fiat on-ramp.

-

Fees:

-

Express: 0.5–0.9%.

-

ProTrade: Maker 0.10%, Taker 0.20%.

-

-

Assets & Tools:

-

20+ major tokens, IDX index for simplified portfolio exposure.

-

-

User Tips:

-

Use ProTrade to lower transaction costs.

-

Be aware of occasional customer support delays, as noted in Reddit feedback.

-

-

Ideal User: Canadian users wanting a simple, compliant fiat-native experience.

|

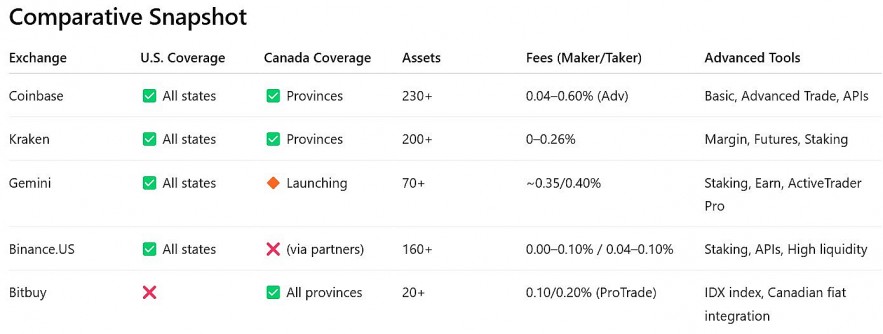

| Comparative Snapshot |

Expert Advice: Choosing & Using Exchanges

1. Define Your Objective

-

Long-term HODLing: Choose platforms with insured storage (Coinbase, Gemini, Kraken, Bitbuy).

-

Active Trading: Go with low-fee, high-liquidity platforms (Binance.US, Kraken Pro).

-

Yield-Seeking: Compare staking/interest options: Kraken (up to 17%), Gemini Earn (4–8%), Coinbase staking.

2. Regulatory & Tax Readiness

-

U.S.: All platforms issue 1099 forms. New IRS rules like potential wash-sale treatment may apply.

-

Canada: Bitbuy issues tax slips, and Kraken & Coinbase Canada are registered under FINTRAC since early 2024.

3. Security First

-

Enable 2FA on every account.

-

Use hardware wallets (Ledger, Trezor) for long-term storage.

-

Beware of phishing: always verify URLs and never respond to unsolicited calls—Coinbase warns of impersonation scams.

4. Fee Optimization Strategy

-

Frequent traders: use Pro versions (Coinbase Advanced, Kraken Pro, Bitbuy ProTrade) for lowest fees.

-

For occasional buys: pay the convenience premium on Coinbase or Gemini.

-

Always compare maker vs. taker rates and consider subscription models (Coinbase One).

5. Diversify & Stay Informed

-

Distribute assets across platforms for redundancy and access to various features.

-

Stay updated: follow official blogs, Twitter/X handles, and subscribe to news alerts.

Final Recommendation Grid

| Investor Type | Best Option(s) |

|---|---|

| U.S. Beginner | Coinbase – simple interface, full insurance; Gemini – regulated and insured. |

| U.S. Active/Pro Trader | Kraken Pro – low fees & futures; Binance.US – ultra-low fees. |

| Canada Beginner & HODLer | Bitbuy – local fiat, easy interface, fully regulated. |

| Canada Looking for Altcoins | Kraken or Coinbase – more tokens and trading tools. |

Final Thoughts

No single exchange dominates everything. The right one depends on your location, trading style, security needs, and asset preferences. Here's the bottom line:

-

Start safe: Coinbase, Gemini, or Bitbuy for insured, easy buys.

-

Step up fees: Kraken and Binance.US for traders and yield seekers.

-

Stay safe: Use hardware wallets, strong authentication, and cross-platform diversification.

Ready to dig deeper into tax forms, staking guides, API integrations, or compliance rules? Just say the word—I’ve got your back.

XRP Surges: What’s Fueling the 14% Rally and What Comes Next? XRP Surges: What’s Fueling the 14% Rally and What Comes Next? The price of XRP surged nearly 14% to $2.57 in the latest session, grabbing the market’s attention. |

Who Is Jeffy Yu? Crypto Prodigy Fakes Death: Biography, Discovery and Confession Who Is Jeffy Yu? Crypto Prodigy Fakes Death: Biography, Discovery and Confession Jeffy Yu, Zerebro crypto co-founder, shocked the internet by faking his death during a livestream—only to be found alive days later at his parents’ home ... |

What Is the GENIUS Act? The U.S. Stablecoin Regulation Bill What Is the GENIUS Act? The U.S. Stablecoin Regulation Bill A bold step toward crypto clarity—or a political firestorm in disguise? The GENIUS Act could redefine how America regulates stablecoins. |

Fidelity Launches Crypto IRAs, Bringing Bitcoin, Ethereum, and Litecoin to Retirement Accounts Fidelity Launches Crypto IRAs, Bringing Bitcoin, Ethereum, and Litecoin to Retirement Accounts Fidelity Investments is reshaping retirement investing with the debut of Fidelity Crypto for IRAs, giving U.S. investors direct access to digital assets like Bitcoin, Ethereum, ... |