Powerball Jackpot September 15, 2025: How State Laws in Texas and California Impact Winnings, Taxes, and Privacy

What Would You Do with $893 Million? Powerball Winners Face the Ultimate Wealth Dilemma What Would You Do with $893 Million? Powerball Winners Face the Ultimate Wealth Dilemma |

Texas vs. Missouri: How State Laws Impact the Powerball Winners’ Privacy and Taxes Texas vs. Missouri: How State Laws Impact the Powerball Winners’ Privacy and Taxes |

On Monday, September 15, 2025, the Powerball jackpot is estimated at $64 million (cash option about $30.9 million before taxes). While the odds of winning remain long, the way you claim your prize and how much you keep after taxes can vary dramatically depending on your state.

Two of America’s most high-profile states, Texas and California, have notably different lottery rules. Understanding how these differences work can save winners millions — and protect their privacy.

Powerball Jackpot Basics

-

Drawing Date: Monday, September 15, 2025

-

Estimated Jackpot: $64 million (annuity) | $30.9 million (cash)

-

Odds of Winning Grand Prize: 1 in 292.2 million

-

Ticket Cost: $2 per play (optional Power Play $1 extra)

|

| The $64 million Powerball jackpot |

State-by-State Differences: Texas vs California

Privacy and Anonymity

-

Texas: Winners of prizes over $1 million can remain anonymous by law. This protects identity, limits media exposure, and reduces security risks.

-

California: State law requires disclosure of the winner’s name and the city of residence. The California Lottery treats transparency as a public-record obligation.

State Income Tax on Lottery Winnings

-

Texas: No state income tax on lottery winnings. Only federal tax (24% upfront withholding; potential 37% marginal).

-

California: Also no state income tax on lottery winnings (since 1984), but certain local and other taxes can still apply.

Claim Deadlines

-

Texas: 180 days from the draw date.

-

California: 180 days for draw games, but some claim processes differ by region.

| Feature | Texas | California |

|---|---|---|

| Anonymity Allowed? | Yes | No |

| State Tax on Winnings | 0% | 0% |

| Claim Deadline | 180 days | 180 days |

| Payment Options | Lump Sum or Annuity | Lump Sum or Annuity |

Payout Example: $64 Million Jackpot

| State | Cash Option | Federal Withholding (24%) | Net After Fed Tax | Additional State Tax | Final Take-Home* |

|---|---|---|---|---|---|

| Texas | $30.9M | –$7.4M | $23.5M | $0 | $23.5M |

| California | $30.9M | –$7.4M | $23.5M | $0 | $23.5M |

*Assumes no additional federal tax bracket adjustments. Actual take-home could be lower depending on deductions and marginal rate.

Tips for Claiming a Powerball Prize Safely

-

Sign the Ticket Immediately: This prevents theft and solidifies ownership.

-

Consult a Lawyer and Financial Advisor: Especially in states requiring disclosure.

-

Plan for Taxes and Privacy: Set aside funds for federal taxes beyond the initial withholding.

-

Consider a Trust: In some states, trusts can claim prizes, adding a layer of privacy (check local laws first).

-

Avoid Scams: The lottery never contacts winners by phone or email — you must claim officially.

Impact of Anonymity on Winners

-

Security: Anonymous winners in Texas can avoid extortion attempts or harassment.

-

Media Pressure: California winners often face intense public scrutiny and requests for interviews.

-

Financial Planning: Public winners may need extra security, estate planning, and media coaching.

Why State Laws Matter

The differences between Texas and California highlight how lottery laws reflect each state’s political culture — Texas prioritizing privacy, California emphasizing transparency. For players, these differences mean the same winning ticket can have very different personal consequences.

FAQs About the September 15, 2025 Powerball Jackpot

Q1: How big is the Powerballjackpot on September 15, 2025?

A: The estimated jackpot is $64 million with a cash option of about $30.9 million before taxes.

Q2: What time is the Powerball drawing?

A: Drawings take place at 10:59 p.m. Eastern Time on Mondays, Wednesdays, and Saturdays.

Q3: Can Powerball winners remain anonymous?

A: In Texas, yes for prizes over $1 million. In California, no — the winner’s name and city are public record.

Q4: Do Texas and California tax lottery winnings?

A: Neither state imposes state income tax on lottery winnings. Only federal taxes apply.

Q5: How long do I have to claim a winning ticket?

A: Both states give 180 days from the draw date to claim Powerball prizes.

Q6: What’s the difference between the annuity and cash option?

A: The annuity pays the full advertised jackpot in 30 graduated payments over 29 years; the cash option is a lump sum, typically about half the advertised amount.

Q7: Should I hire an attorney if I win?

A: Yes. An attorney can help with privacy strategies, trust formation, and financial planning.

Q8: Does winning Powerball affect federal benefits?

A: Yes. Large lump-sum income can affect tax brackets and eligibility for certain benefits; consult a CPA.

Q9: How does federal withholding work?

A: The IRS requires a 24% upfront withholding on large lottery prizes, but your actual tax liability could be up to 37% depending on total income.

Q10: Where can I check the winning numbers?

A: On the official Powerball website, your state’s lottery site, or through authorized apps after 11 p.m. ET on draw nights.

Conclusion

The $64 million Powerball jackpot on September 15, 2025 is more than just a big payday — it’s also a case study in how state laws shape winners’ lives. While both Texas and California winners would face similar federal taxes, Texas law offers anonymity and California demands transparency.

Whether you’re playing for fun or planning for a once-in-a-lifetime win, knowing the rules where you buy your ticket can protect your privacy, maximize your payout, and set you up for a more secure future.

Powerball winning numbers lottery drawing jackpot: Results, Who win? Powerball winning numbers lottery drawing jackpot: Results, Who win? The Powerball lottery jackpot continues to grow after no one matched all six numbers from Saturday night's drawing. |

Powerball, Mega Millions history: Top 10 U.S lottery drawing jackpot results Powerball, Mega Millions history: Top 10 U.S lottery drawing jackpot results Here are the nation's all-time top 10 Powerball and Mega Millions jackpots, according to powerball.com: |

Powerball: Top 10 funny facts, how to play, and recent winners Powerball: Top 10 funny facts, how to play, and recent winners Powerball is one of the biggest and most famous lotteries in the U.S., offering prizes that can reach billions of dollars. |

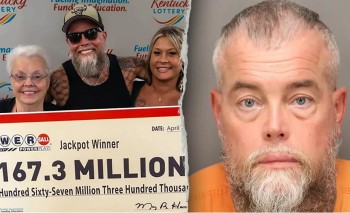

Who is James Farthing? From Jackpot to Jail of Powerball Winner Who is James Farthing? From Jackpot to Jail of Powerball Winner James Farthing, a $167 million Powerball winner, was arrested just days after his historic win for assaulting a deputy during a violent altercation at a ... |

Two Powerball Players Hit Nearly $1.8 Billion Jackpot — Who Are the Lucky Winners? Two Powerball Players Hit Nearly $1.8 Billion Jackpot — Who Are the Lucky Winners? Historic Powerball drawing splits between Texas and Missouri; tax decisions, financial forecasts, and national reactions follow. |