Social Security Overpayments: What They Are and How to Avoid Them

Social Security Fraud? The Truth Behind Trump and Musk’s Allegations Social Security Fraud? The Truth Behind Trump and Musk’s Allegations |

Are Millions of Dead People Getting Social Security? Here’s What the Data Really Says Are Millions of Dead People Getting Social Security? Here’s What the Data Really Says |

|

| Did Social Security Overpay You? Know Your Rights! |

The Costly Reality of Overpayments

Every month, the Social Security Administration (SSA) distributes approximately $1.6 trillion in benefits annually to around 70 million Americans. These benefits serve as a crucial financial safety net for retirees, disabled individuals, and low-income families. However, due to administrative complexities, billions of dollars in Social Security overpayments occur each year—leaving many beneficiaries confused, frustrated, and sometimes facing financial hardship.

According to a July 2024 report from the SSA Inspector General, from 2015 to 2022, the SSA overpaid beneficiaries by approximately $71.8 billion—a small percentage of total disbursements but still a significant figure. With increased scrutiny on government spending, Social Security overpayments have become a pressing issue, raising important questions:

- What causes overpayments?

- How does the SSA recover them?

- What can beneficiaries do if they receive an overpayment notice?

What is a Social Security Overpayment?

A Social Security overpayment occurs when the SSA sends more benefits than a person is eligible to receive. This can happen in multiple programs, including Social Security retirement, disability (SSDI), and Supplemental Security Income (SSI).

For example, suppose an SSDI recipient returns to work but fails to notify the SSA about their increased income. If their earnings exceed the allowed limit but they continue receiving full benefits, the SSA may later determine that they were overpaid and demand repayment.

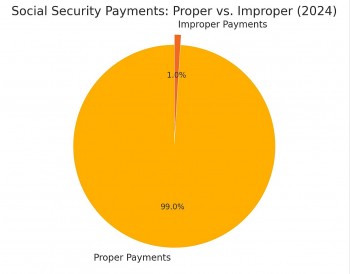

How Common Are Overpayments?

Overpayments account for less than 1% of total Social Security payments, but they still impact millions of Americans. A 2022 Inspector General report found that 73,000 overpayments resulted from SSA miscalculations due to ineffective oversight of benefit computation.

Common Causes of Overpayments

The most frequent reasons for overpayments include:

- Failure to report income changes – This is especially common for SSI and SSDI recipients, where earning too much can reduce or eliminate eligibility.

- Marriage, divorce, or family status changes – Certain benefits (such as spousal benefits) depend on marital status, and failure to update SSA records can lead to incorrect payments.

- Improvement in disability status – If a disabled recipient’s condition improves, they may no longer qualify for benefits, but the SSA may continue payments due to delayed record updates.

- Administrative errors by the SSA – Sometimes, overpayments happen due to miscalculations by the SSA itself. For example, a recipient might provide the correct income updates, but the agency fails to process them in a timely manner.

What Happens If You Get an Overpayment Notice?

If the SSA determines that you've been overpaid, they will send an official overpayment notice detailing:

- The overpaid amount

- Why the overpayment occurred

- Repayment options

- How to appeal or request a waiver

The SSA usually withholds 100% of a beneficiary’s future Social Security payments until the overpayment is fully recovered. However, new rules as of 2024 allow some beneficiaries to opt for a lower repayment rate (10% withholding) in cases of hardship.

How Do You Pay Back an Overpayment?

If you owe money to the SSA, repayment options include:

- Online payment via debit/credit card

- Bank transfer or check

- Monthly deductions from future benefits

If you are no longer receiving benefits and fail to repay, the SSA can garnish wages, take federal tax refunds, or report delinquencies to credit bureaus.

Can You Appeal an Overpayment?

Yes. If you believe the SSA is wrong, you can file an appeal within 60 days of receiving the overpayment notice. Beneficiaries can appeal based on:

- Disputing the overpayment amount – If you believe the SSA miscalculated, you can request a review.

- Requesting a waiver – If the overpayment was not your fault and repaying would cause financial hardship, you can request a waiver.

- Negotiating a lower repayment plan – If full repayment isn’t feasible, the SSA may approve a lower monthly deduction.

Example Case: In 2023, a retired woman in Texas was notified that she owed the SSA $14,500 due to a miscalculation in her spousal benefits dating back eight years. Since the error was not her fault, she successfully had the repayment waived.

How to Avoid a Social Security Overpayment

To avoid overpayments and ensure compliance with SSA regulations:

- Report Changes Promptly – Notify the SSA immediately of income changes, work status updates, marriage, divorce, or disability improvement.

- Monitor Your SSA Account – Use My Social Security online to track payments and benefit calculations.

- Be Cautious of Unexpected Increases – If your payment increases unexpectedly, call the SSA to verify the reason.

- Keep Records – Maintain copies of all correspondence and updates you send to the SSA.

Final Thoughts: A Complex but Fixable Issue

Social Security overpayments, though relatively rare, affect thousands of Americans each year—often through no fault of their own. While the SSA has legal obligations to recover taxpayer money, it also provides appeals and waiver processes for those facing hardship.

Understanding why overpayments happen, how they’re recovered, and how to dispute them empowers beneficiaries to navigate the system effectively and avoid unnecessary financial stress.

Have You Experienced a Social Security Overpayment?

If you’ve received an overpayment notice, what was your experience like? Share your thoughts in the comments or reach out to the SSA for support.

When Will the First COLA-Adjusted Payments Arrive in January 2025? When Will the First COLA-Adjusted Payments Arrive in January 2025? The Social Security Administration (SSA) implements annual Cost-of-Living Adjustments (COLA) to ensure that Social Security benefits keep up with inflation. For 2025, millions of beneficiaries ... |

How Upcoming Changes to US Retirement Age Impact Americans Over 50 How Upcoming Changes to US Retirement Age Impact Americans Over 50 The landscape of retirement in the United States is evolving, with significant changes to Social Security and the retirement age on the horizon. For Americans ... |

Tips to Maximize Social Security Benefits in 2025 Tips to Maximize Social Security Benefits in 2025 In this article, we’ll explore practical strategies to help both workers and retirees optimize their benefits in 2025 and beyond. |

What is Social Security Fairness Act: Key Provisions and Changes What is Social Security Fairness Act: Key Provisions and Changes On January 5, 2025, President Joe Biden signed the Social Security Fairness Act into law, marking a significant milestone in enhancing retirement benefits for millions ... |