Top 10 Youngest Billionaires in America 2026 (Updated List)

Why the United States Is the Richest Country in the World but Still Has So Many Homeless People Why the United States Is the Richest Country in the World but Still Has So Many Homeless People |

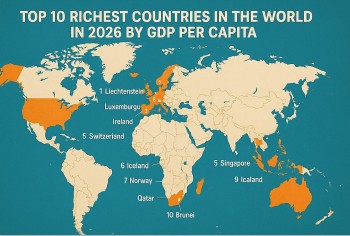

Top 10 Richest Countries in 2026 by GDP Per Capita Top 10 Richest Countries in 2026 by GDP Per Capita |

The list of the youngest billionaires in America has changed sharply over the past year. Stock prices, private valuations, and the rapid rise of artificial intelligence have reshaped who makes the cut and in what order. Some familiar names remain, but new figures from the AI boom have moved straight to the top.

Below is an updated, age-based ranking of the youngest U.S. billionaires in 2026, using the most recent widely cited net worth estimates. Ages come first in the ranking, followed by estimated wealth and source of fortune.

Read more: Top 10 Youngest Self-Made Billionaires in the World

|

| Top 10 Youngest Billionaires in America |

1. Alexandr Wang (28)

Net worth: ~$3.2 billion

Wang is the youngest billionaire in America, built almost entirely on artificial intelligence. As founder and CEO of Scale AI, he provides data infrastructure that powers AI systems for companies and governments alike. The explosive demand for AI training data has pushed Scale AI’s valuation higher, turning Wang into a symbol of how fast the AI economy is creating new wealth.

2. Lucy Guo (30)

Net worth: ~$1.3 billion

Guo co-founded Scale AI with Wang and retained a significant stake after leaving the company. Her rise highlights a broader shift in 2026: more young billionaires are emerging from early equity positions in private tech firms rather than long-established public companies.

3. Evan Spiegel (35)

Net worth: ~$2.6 billion

The Snapchat co-founder remains one of America’s best-known young tech billionaires. While social media growth has slowed compared with its early years, Snap’s investments in augmented reality and advertising tools continue to support Spiegel’s fortune.

4. Bobby Murphy (37)

Net worth: ~$1.9 billion

Murphy, Snap’s technical co-founder, plays a quieter role than Spiegel but remains central to the platform’s engineering and long-term strategy. Together, they remain one of the most successful co-founder pairs of the past decade.

5. Fred Ehrsam (37)

Net worth: ~$2.8 billion

Ehrsam helped build Coinbase into a leading U.S. crypto exchange and later co-founded Paradigm, a major crypto investment firm. Despite market volatility, crypto infrastructure and long-term blockchain adoption continue to underpin his wealth.

6. Lukas Walton (39)

Net worth: ~$44.3 billion

The grandson of Walmart founder Sam Walton remains the wealthiest person on this list by far. While his fortune is inherited, Walton is known for directing capital into environmental, impact, and long-term investment projects rather than operating Walmart directly.

7. Eduardo Vivas (39)

Net worth: ~$4.8 billion

Vivas made his fortune in mobile advertising technology, benefiting from the continued growth of app-based marketing and performance advertising platforms tied to AppLovin’s success.

8. Josh Kushner (40)

Net worth: ~$5.2 billion

As founder of Thrive Capital, Kushner has backed some of the most influential tech companies of the last decade. His wealth reflects the growing power of venture capital in shaping the modern U.S. economy.

9. Baiju Bhatt (40)

Net worth: ~$6.5 billion

Bhatt co-founded Robinhood, the trading app that reshaped retail investing. Despite regulatory scrutiny and market swings, Robinhood’s scale keeps Bhatt firmly among America’s youngest billionaires.

10. Mark Zuckerberg (41)

Net worth: ~$223.3 billion

Now just over 40, Zuckerberg still qualifies for many “young billionaire” lists. His wealth surged again as Meta doubled down on AI, advertising efficiency, and long-term platform control.

What this ranking reveals in 2026

The updated list shows a clear pattern: AI and software now create billionaires faster than any other sector. Unlike earlier generations dominated by retail, real estate, or finance, today’s youngest billionaires often reach that status before 35, driven by private valuations and concentrated equity stakes.

At the same time, inherited wealth remains powerful at the top, as seen with Lukas Walton. The contrast between AI founders and legacy heirs underscores how America’s wealth landscape now combines rapid innovation with long-established fortunes.