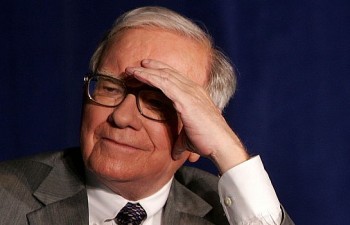

Who Is Greg Abel? Warren Buffett’s Successor: Biography, Career, Family, And Net Worth

In one of the most anticipated succession plans in modern corporate history, Warren Buffett has officially named Greg Abel as his successor to lead Berkshire Hathaway. The announcement, made during the conglomerate’s 60th annual shareholders meeting on May 4, 2025, marks the beginning of a new chapter for one of the most closely watched companies in the world.

At 94, Buffett said, “The time has arrived where Greg should become the Chief Executive Officer of the company at year-end.” With that, the torch is set to pass from the Oracle of Omaha to a man who has spent decades quietly rising through the ranks of one of America's most powerful business empires.

But who is Greg Abel — and what kind of future awaits Berkshire Hathaway under his leadership?

Read more: How did Warren Buffett Make Money Amid Trump’s Tariff War?

|

| Greg Abel - New Berkshire Hathaway CEO |

Early Life and Education

Gregory Edward Abel was born on June 1, 1962, in Edmonton, Alberta, Canada. The youngest of four children, he grew up in a working-class household that instilled in him values of discipline, humility, and hard work.

He worked odd jobs in his teens — delivering newspapers, collecting bottles for refunds, even doing data entry — long before becoming a corporate heavyweight. Abel graduated from the University of Alberta in 1984 with a degree in commerce, majoring in accounting. He later became a Certified Public Accountant (CPA).

Though Abel was a strong student, he was equally passionate about sports — especially ice hockey, which he played competitively in Canada. That mix of sharp thinking and quiet grit would come to define his career.

Career Journey and Rise Through Berkshire

Early Roles and Entry into Energy Sector

Abel started his career at PricewaterhouseCoopers (PwC) in San Francisco before joining CalEnergy in 1992 — a renewable energy company then based in Omaha. When CalEnergy bought MidAmerican Energy, an Iowa utility, in 1999, Abel stayed on and steadily climbed to executive leadership.

In 2000, Warren Buffett’s Berkshire Hathaway bought a controlling stake in MidAmerican. Abel was quickly recognized for his strategic insight and operational focus.

By 2008, he had become CEO of MidAmerican, which would later evolve into Berkshire Hathaway Energy (BHE). Under his leadership, BHE grew into one of the largest energy producers in North America, with major investments in renewables, particularly wind and solar power.

Vice Chairman of Berkshire Hathaway

In 2018, Abel was appointed Vice Chairman for Non-Insurance Businesses at Berkshire Hathaway — overseeing a diverse portfolio of subsidiaries, including:

-

BNSF Railway

-

Duracell

-

See’s Candies

-

Dairy Queen

-

Precision Castparts

His oversight of nearly 90 operating companies demonstrated a deep operational grasp across sectors ranging from energy and transportation to food and manufacturing.

Read more: Who is Warren Buffett: Biography, Personal Life and Net Worth

Leadership Philosophy and Business Approach

Abel is known for being decisive, data-driven, and loyal to Berkshire's decentralized model — a key reason Buffett trusts him with the future of the company.

He avoids media spotlights, gives few interviews, and prefers operating behind the scenes. But among insiders, he's respected as a sharp dealmaker who:

-

Delegates authority while maintaining accountability

-

Makes long-term decisions over short-term gains

-

Respects the Berkshire “hands-off” tradition of giving managers autonomy

Buffett once said: “Greg understands capital allocation, business culture, and the importance of staying out of the way when leaders are doing well.”

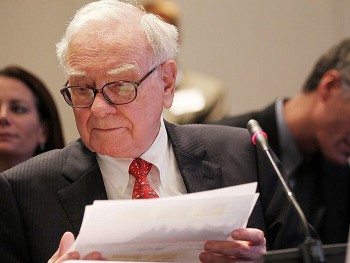

Personal Life and Family

Despite leading one of the most influential business divisions in the country, Abel has maintained a remarkably low public profile.

He is married to Andrea Abel, and they have four children. The family resides in Des Moines, Iowa, where he keeps close ties to the community. Abel is also a devoted supporter of youth hockey, serving on the board of Hockey Canada Foundation.

He plays golf, reads extensively on business and economics, and is said to share Buffett’s passion for frugality — often flying coach and driving modest cars, even as a top executive.

|

| Gregory Abel, the New CEO of Berkshire Hathaway |

Wealth, Holdings, and Net Worth

Greg Abel’s net worth is estimated at $484 million as of 2024. This wealth stems from:

-

His long tenure and bonuses at Berkshire Hathaway Energy

-

The sale of his 1% stake in BHE for $870 million in 2022

-

Stock options and holdings in Berkshire Hathaway

Though far from Buffett’s multibillion-dollar fortune, Abel’s financial standing ensures he has “skin in the game” — a crucial trait Buffett has always demanded of top executives.

The Future of Berkshire Hathaway Post-Buffett

What Will Change?

Abel is expected to preserve the core ethos of Berkshire — buy great businesses, hold them forever, avoid fads, and let managers manage.

However, he may bring greater focus to sustainability, technology infrastructure, and scaling Berkshire’s energy and utilities portfolio, given his expertise.

He will not be alone in this task. Berkshire's vast $350 billion stock portfolio will be managed by Todd Combs and Ted Weschler, ensuring investment continuity even after Buffett’s departure.

Market Confidence

Analysts have expressed confidence in the transition, noting that:

-

Abel has already proven himself across industries

-

Buffett’s endorsement carries immense weight

-

Berkshire’s structure was built for continuity, not personality

Final Thoughts

The transition from Warren Buffett to Greg Abel marks more than just a change in leadership — it's the continuation of a philosophy, a culture, and an unparalleled legacy.

Abel won’t try to imitate Buffett — nor should he. What he brings is his own quiet competence, deep operational insight, and an unwavering respect for Berkshire’s DNA.

As the company navigates its post-Buffett era, all eyes will be on Greg Abel — a Canadian accountant who has become one of the most powerful CEOs in American capitalism.

What was Warren Buffett's Biggest Investment Mistake? What was Warren Buffett's Biggest Investment Mistake? One of the worst decisions of Warren Buffett's career, according to him, was the purchase of the shoe manufacturer Dexter Shoe. Additionally, Buffett foresaw that ... |

3 Investment Lessons From 2024 Warren Buffett's Letter to Shareholders (And Full Text) 3 Investment Lessons From 2024 Warren Buffett's Letter to Shareholders (And Full Text) Warren Buffett is one of the world's most successful investors. Investors consistently notice and appreciate the advice he provides to Berkshire Hathaway shareholders in his ... |