Why Social Security Payments Are Being Suspended in 2025 - and How to Restore Them

Major Changes to Social Security Identity Checks in April 2025 – How It Affects Your Benefits Major Changes to Social Security Identity Checks in April 2025 – How It Affects Your Benefits |

When Do Social Security Payments Go Out in May? The Full 2025 Payment Schedule When Do Social Security Payments Go Out in May? The Full 2025 Payment Schedule |

|

| Although Social Security payments are generally issued without problems, the Administration can stop sending checks to individuals who no longer meet eligibility requirements. |

Social Security benefits are a financial lifeline for millions of Americans. Yet in 2025, a growing number of retirees and disability beneficiaries are experiencing payment suspensions due to administrative changes, stricter enforcement, and personal eligibility issues.

Understanding why this is happening—and how to fix it—is critical to protecting your income.

Why Are Social Security Payments Being Suspended?

1. Stricter Identity Verification Requirements

As of April 14, 2025, the Social Security Administration (SSA) requires certain beneficiaries to verify their identity in person if they cannot do so online. This policy aims to combat fraud but has led to delays, especially for seniors and rural residents facing office closures and long wait times.

2. Overpayment Recovery at 100% Withholding

Effective March 27, 2025, the SSA reinstated a policy to recover overpayments by withholding 100% of a beneficiary's monthly check until the debt is repaid. Previously, the withholding rate was capped at 10%. This change has caused financial strain for many beneficiaries.

3. Failure to Respond to SSA Communications

Ignoring SSA requests for updated information, such as income verification or medical reviews, can result in payment suspensions. The SSA may interpret non-response as noncompliance.

4. Exceeding Income or Resource Limits

Beneficiaries who earn income above allowable limits, especially under Supplemental Security Income (SSI), risk suspension. For example, returning to work without reporting income can trigger a halt in benefits.

5. Prolonged Absence from the U.S.

Living outside the United States for more than 30 consecutive days without notifying the SSA can lead to suspension of benefits, particularly for SSI recipients.

6. Changes in Personal Circumstances

Events such as marriage, divorce, incarceration, or changes in immigration status can affect eligibility and result in suspended payments if not promptly reported.

How to Reinstate Suspended Social Security Benefits

1. Contact the SSA Immediately

If your benefits are suspended, reach out to the SSA promptly to determine the reason and the steps needed for reinstatement.

-

Phone: 1-800-772-1213 (TTY: 1-800-325-0778)

-

Online: ssa.gov

-

In Person: Visit your local SSA office (appointments recommended).

2. Provide Required Documentation

Submit any requested documents, such as proof of income, residency, or medical records, to verify continued eligibility. Ensure all information is accurate and up to date.

3. Request Expedited Reinstatement (EXR) for Disability Benefits

If your disability benefits ended due to work and you are now unable to work because of the same condition, you may qualify for EXR.

-

Eligibility: You must request EXR within five years of benefit termination and be unable to perform substantial gainful activity due to your disability.

-

Process: Submit Form SSA-371 (for SSDI) or SSA-372 (for SSI) to your local SSA office. You may receive provisional benefits for up to six months while your request is reviewed.

4. Appeal or Request a Waiver for Overpayments

If you receive an overpayment notice:

-

Appeal: You have the right to appeal the overpayment decision.

-

Waiver: If the overpayment was not your fault and you cannot afford to repay it, you can request a waiver.

Contact the SSA to discuss your options and submit the necessary forms.

Tips to Prevent Future Suspensions

-

Keep Information Updated: Notify the SSA promptly about changes in income, address, marital status, or immigration status.

-

Respond to Communications: Always respond to SSA requests for information or documentation in a timely manner.

-

Monitor Your Benefits: Regularly check your benefit status through the SSA's online portal.

-

Seek Assistance: If you're unsure about any requirements or notices, consult with a Social Security expert or attorney.

Staying informed and proactive is key to ensuring uninterrupted Social Security benefits. By understanding the reasons behind payment suspensions and knowing the steps to address them, beneficiaries can better navigate these challenges.

Frequently Asked Questions (FAQs)

1. Why did my Social Security check stop without warning?

Common reasons include failure to verify identity, unreported income, missed SSA communications, or system-wide policy changes. Contact the SSA immediately to clarify the cause.

2. Can I get back missed payments if my benefits were suspended?

Yes. If you qualify for reinstatement, the SSA may issue retroactive payments for the months you were eligible but did not receive funds.

3. How do I know if I was overpaid by Social Security?

You’ll receive an official notice from the SSA explaining the overpayment amount, the reason, and your rights to appeal or request a waiver.

4. What is Expedited Reinstatement (EXR)?

EXR allows previous disability beneficiaries to restart benefits quickly if their condition prevents them from working again. You must apply within five years of your last payment.

5. Does living abroad affect my Social Security benefits?

Yes. If you receive SSI and live outside the U.S. for more than 30 consecutive days, your payments may be suspended. SSDI rules are more flexible but still require reporting.

6. Can I appeal a suspended Social Security payment?

Absolutely. You can file a reconsideration request or appeal online, by mail, or in person. You generally have 60 days from the notice date to act.

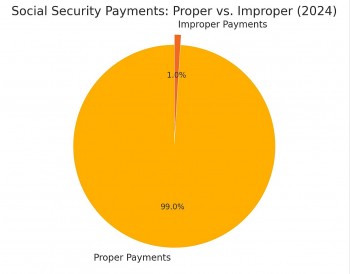

Social Security Fraud? The Truth Behind Trump and Musk’s Allegations Social Security Fraud? The Truth Behind Trump and Musk’s Allegations In recent months, allegations of widespread fraud within the U.S. Social Security program have emerged, notably from President Donald Trump and Elon Musk, head of ... |

Are Millions of Dead People Getting Social Security? Here’s What the Data Really Says Are Millions of Dead People Getting Social Security? Here’s What the Data Really Says Claim: Millions of deceased individuals are still receiving Social Security benefits. |

Social Security Overpayments: What They Are and How to Avoid Them Social Security Overpayments: What They Are and How to Avoid Them This article breaks down the causes, consequences, and solutions for Social Security overpayments—and what every recipient should know to avoid them. |