How Credit-Card Debt Became America’s Real Poverty Line

How Americans Learned to Survive 2025 — and Win 2026 How Americans Learned to Survive 2025 — and Win 2026 Learn the new rules of survival in America: mobility, AI adoption, geographic arbitrage, and micro-entrepreneurship. |

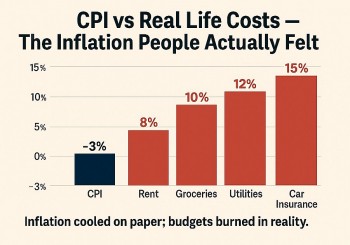

Why Americans Felt Poorer in 2025 — Even After Inflation Fell Why Americans Felt Poorer in 2025 — Even After Inflation Fell Inflation cooled in 2025, but Americans still struggled. Explore how sticky prices, rent, and utilities fueled a real-life economic crisis. |

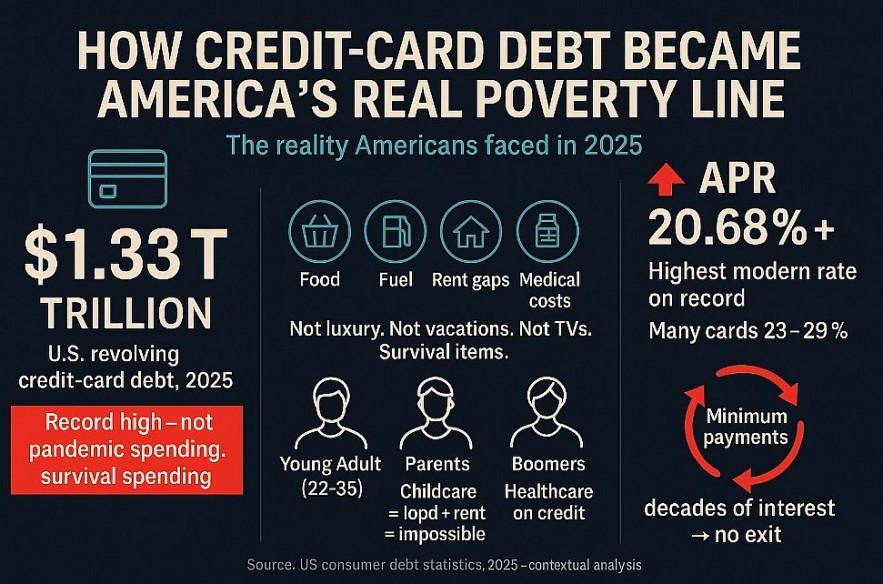

The Year Americans Used Plastic to Breathe

In 2025, America crossed a line that economists pretend is normal but citizens felt in their bones:

credit-card balances became a survival mechanism, not a spending mistake.

The United States hit a new record—$1.33 trillion in revolving credit-card debt.

Not student loans.

Not mortgages.

Not business lending.

Credit-card debt.

The most punitive, predatory, frictionless form of consumer borrowing in a high-cost economy.

People didn’t swipe cards to buy televisions, vacations, or designer clothes.

They swiped for gas. Milk. Rent. Co-pays. Childcare.

Things previous generations paid with cash on a weekly paycheck.

When a nation borrows to eat, something is fundamentally broken.

|

| Credit cards used to be plastic convenience |

1. The $1.33 Trillion Wall — A Number That Isn’t Just “High,” It’s Structural

Americans are used to billion-dollar numbers.

We hear “$1.33 trillion” and shrug.

But to understand the weight, translate it:

-

$1.33 trillion = more than the GDP of many countries.

-

$1.33 trillion = $4,000 for every man, woman, and child in the U.S.

-

$1.33 trillion = millions of households one paycheck from disaster.

This wasn’t pandemic clutter or reckless retail therapy.

It was the price of staying alive in the world’s richest country.

Politicians told voters the economy was strong.

Consumers told Visa, Mastercard, and Capital One something else:

“I can’t afford my life in cash anymore.”

Breakdown by Demographic: Who Fell Deepest Into the Pit

Credit-card debt is not evenly distributed.

Some groups suffered disproportionately:

Young Adults (22–35)

-

Saddled with student debt

-

Stagnant wages in entry-level positions

-

Rent climbing above 35–45% of income

-

No emergency savings

-

Entire adulthood defined by financial triage

A 27-year-old ICU nurse in Tennessee says:

“I swipe for groceries. I Venmo rent. I put gas on Klarna. My life is nothing but payments.”

Parents with School-Age Children

-

The most vulnerable middle-class group

-

Biggest childcare + food + medical bills

-

Zero margins to absorb spikes

They never chased luxury.

They chased stability—and paid for it with interest.

Boomers With Medical Costs

-

Retirements eaten by deductibles

-

30% paying for medications on credit

-

Seniors carrying balances into their 70s

That is not a generational scandal.

It is a national disgrace.

2. APR > 20.68% — The Most Expensive “Safety Net” in U.S. History

Americans didn’t just borrow.

They borrowed at predatory historical highs.

In 2025, average credit card APRs reached 20.68%, the highest modern rate ever recorded.

Many cards—especially for young borrowers—hovered between 23–29%.

This is loan-shark math with glossy branding.

To visualize:

-

If you carry a $3,700 balance (the U.S. median)

-

At 21% APR

-

And pay minimums

It may take 15–20 years to pay it down.

For groceries.

For diapers.

For the dentist.

Not for a boat.

Economists call the credit system “short-term consumer liquidity.”

Americans call it what it is:

“The most expensive grocery store loan in existence.”

3. What Americans Are Actually Charging: The End of Aspirational Spending

Let’s kill the myth that credit-card debt is a luxury problem.

The number one category of purchases in 2025 wasn’t travel nor electronics—it was food.

Then:

-

utilities

-

fuel

-

childcare

-

car insurance

-

pharmacy

-

copayments

-

rent gaps

Americans weren’t irresponsible.

They were priced out of living.

A Washington state teacher said:

“I don’t use my card to splurge. I use it when the fridge is empty.”

A Lyft driver in Philadelphia:

“Gas goes on the card. Always. I’m basically working for Visa.”

A single mother in Austin:

“My daughter’s medication is on credit. That debt is a life sentence.”

These aren’t dramatic outliers—

they’re the median experience of millions.

4. How Banks Profit from Despair — The Fintech-Styled Extraction Machine

Credit-card economics is simple:

-

Raise rates.

-

Encourage revolving usage.

-

Penalize late fees.

-

Increase minimums.

-

Extend repayment window indefinitely.

Banks do not need consumers to default.

They need them to survive—just barely.

A customer who fails = loss.

A customer who suffers = asset.

Wall Street doesn’t want you to be rich or bankrupt.

It wants you to be tired.

The Interest Paradox

When people struggle most, they rely on cards fastest.

This produces self-feeding profit cycles:

-

Grocery prices spike → people borrow → banks profit

-

Rent rises → people borrow → banks profit

-

Medical bills arrive → people borrow → banks profit

The financial sector becomes the landlord of the mind:

You don’t rent an apartment;

you rent space in the future.

5. Why Debt Spread Faster in “Good Job” Households

Here is the paradox of the 2025 economy:

Middle-class professionals were the most likely to drown.

Why?

Because the American economy punishes those who play by the rules.

-

They rent in expensive ZIP codes near jobs

-

They pay for childcare so they can work

-

They buy health insurance

-

They pay for transportation, parking, tolls

-

They save, but inflation erases gains

-

They don’t qualify for aid

-

They don’t negotiate aggressively

-

They absorb the shock quietly

A junior software developer in Denver said:

“I make $108k. I should be comfortable. Instead I feel like I’m barely treading water.”

A marketing manager in Chicago:

“Everything I own is financed. It feels like someone else owns my life.”

These weren’t irresponsible adults.

They were high-achieving Americans trapped in a system where success comes with penalties.

6. The Debt Psychology: When Borrowing Feels Like Breathing

Why didn’t Americans revolt?

Why did they swipe so calmly?

Because credit cards don’t ask you to believe in the future.

They only ask you to survive the present.

Debt is not emotional at first.

It becomes emotional over time.

At $200 balance, you’re anxious.

At $6,000 balance, you’re numb.

At $15,000 balance, you’re hopeless.

Debt creates psychological learned helplessness:

-

You stop budgeting.

-

You stop planning.

-

You stop dreaming.

-

You stop believing your decisions matter.

This is the true poverty line—

not the dollar amount, but the moment you surrender agenc7. Who Wants You to Stay in Debt? Everyone Except You

Every major U.S. institution benefits from credit dependency:

-

landlords

-

insurance companies

-

hospitals

-

telecoms

-

airlines

-

used-car dealers

-

private universities

-

subscription platforms

They all know the same truth:

If Americans paid cash, business models would collapse.

Credit is the lubricant of the modern U.S. economy.

It fills the gap between the wage you earn and the life you’re expected to fund.

Debt is the bridge between your dignity and their profit.

8. 2026 Forecast: Defaults, Consolidation, and a Fintech Shock

The American consumer is entering 2026 with four dangerous traits:

-

High balances

-

High interest

-

Low savings

-

High resentment

This mix produces three likely outcomes:

Prediction 1: A Wave of Quiet Defaults

Not dramatic bankruptcies—silent ones:

-

Accounts closed

-

Minimum payments dropped

-

Charge-offs

-

Aggressive collection

-

Credit score implosions

Families won’t default once.

They will default transactionally:

phone, then gas, then rent gap, then insurance, then cards.

Prediction 2: Consolidation of Debt into Large Private Players

Banks know consumers will drown.

They will offer:

-

“Hardship programs”

-

“Consolidation loans”

-

“Flexible repayment solutions”

These are not rescues.

They are collars.

Roll 4 cards into one loan.

Pay interest for 6–10 years.

Banks swallow your future.

Prediction 3: The Rise of Fintech Dissidents

This is the only hopeful arc.

Consumer revolt won’t come from elections.

It will come from infrastructure.

-

Peer-to-peer lending circles

-

Automated refinancing

-

Real-time income smoothing

-

Transparent payment tools

-

Banking alternatives

-

Debt-free subscription models

Fintech won’t disrupt banks with innovation.

It will disrupt them with empathy + mathematics.

Conclusion: Poverty Isn’t a Wage Level. It’s a System of Extraction.

In 2025, Americans didn’t become poor because they lacked money.

They became poor because every institution around them gained more by keeping them indebted than by letting them prosper.

The new U.S. poverty line is not $27,000 or $36,000 or whatever the Census Bureau prints next year.

The real American poverty line is the moment you can only afford life if you borrow from tomorrow.

Credit cards used to be plastic convenience.

Now they are the oxygen mask of a suffocating middle class.

And as 2026 begins, Americans face a brutal question:

Are we going to keep breathing debt, or will we finally learn to breathe without it?

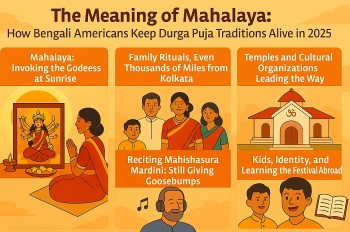

The Meaning of Mahalaya: How Bengali Americans Keep Durga Puja Traditions Alive in 2025 The Meaning of Mahalaya: How Bengali Americans Keep Durga Puja Traditions Alive in 2025 Discover the spiritual significance of Mahalaya and how Bengali Americans across generations are preserving Durga Puja traditions in the U.S. in 2025. A cultural deep ... |

Trump’s $2,000 Tariff Dividend: Who Gets It, How to Claim It, and What You Need to Know Trump’s $2,000 Tariff Dividend: Who Gets It, How to Claim It, and What You Need to Know A new check might be coming your way—if you qualify. Trump promises $2,000 per person from tariff revenue, but the details aren’t as simple as ... |

The Longevity Economy: How Americans Over 50 Are Funding the Future of Anti-Aging Science The Longevity Economy: How Americans Over 50 Are Funding the Future of Anti-Aging Science Why the 50+ crowd is the most powerful force behind Silicon Valley’s race to defeat aging? |

The Hidden Homeless: Why Millions of Americans Are One Paycheck Away From Losing Everything The Hidden Homeless: Why Millions of Americans Are One Paycheck Away From Losing Everything This article takes a deeper look at who the hidden homeless really are, why this group is growing so fast, how close the average American ... |