Why Americans Felt Poorer in 2025 — Even After Inflation Fell

America in 2025: The Ten Moments That Changed Everything America in 2025: The Ten Moments That Changed Everything Explore the 10 turning points that reshaped America in 2025—from AI and housing to politics and culture—and what these shifts mean for 2026. |

How Americans Learned to Survive 2025 — and Win 2026 How Americans Learned to Survive 2025 — and Win 2026 Learn the new rules of survival in America: mobility, AI adoption, geographic arbitrage, and micro-entrepreneurship. |

A Country Where the Numbers Lied

In late 2025, the news cycle began to repeat the same triumphant chorus:

“Inflation has cooled.”

Cable news rolled graphics showing the Consumer Price Index dipping below 3%. Economists took victory laps in opinion columns. Politicians declared that “the worst is behind us.”

But if you listened to everyday Americans—not analysts, not central bankers, not the commentators—you heard something very different:

“I don’t feel richer. I feel exhausted.”

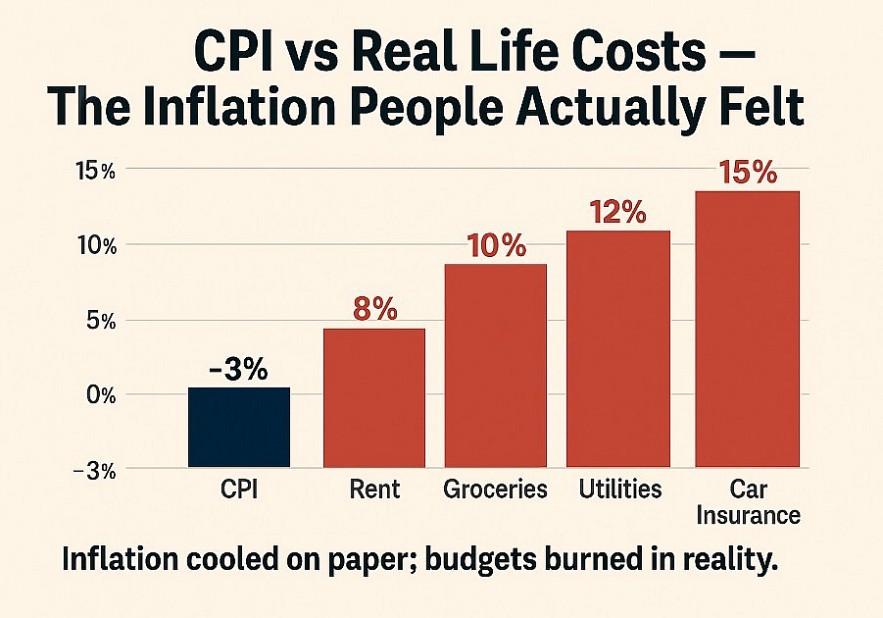

For millions of households, 2025 didn’t feel like a recovery; it felt like economic whiplash. People weren’t celebrating CPI data—they were staring at rent bills, grocery receipts, car insurance premiums, and medical invoices that had climbed higher and then stayed there.

Inflation fell on paper, but prices didn’t.

That difference—the gap between macro statistics and lived reality—defined the American experience in 2025.

|

| CPI vs Real Life Costs — The Inflation People Actually Felt |

1. Sticky Inflation and the Great Misunderstanding of the CPI

Before diving into why 2025 felt so painful, we need to explain something simple that economists understand but average people don’t:

inflation is a rate, not a level.

When CNN says “Inflation fell,” the public hears “prices went down.”

But that’s wrong.

Inflation measures how fast prices increase—not whether they return to normal after a spike.

If a gallon of milk goes from $2.50 to $3.80 in 2023, then rises to $4.10 in 2024, and finally stays at $4.10 in 2025, inflation has fallen—but the price has not.

You’re still spending almost 65% more than three years ago.

Economists call this sticky inflation:

When prices increase—and never come back down.

They stick to the ceiling.

And the stickiest categories aren’t luxury goods or discretionary spending—they are core essentials: food, housing, utilities, transportation, medical costs.

These are the budget line items that define a family’s well-being.

They are also the categories CPI underrepresents in emotional terms.

The government can brag about “price stabilization.”

But the person spending $480/month on groceries instead of $320 doesn’t feel stabilized.

2. Why Groceries Never Came Back Down: The Anatomy of “Forever Prices”

Food isn’t like TVs or laptops. Electronics follow a Moore’s-law-like cycle: tech gets better and cheaper. Groceries don’t. They’re tied to global commodities, weather patterns, labor, logistics, fuel, packaging, and retail margin.

During the pandemic era, supply chains snapped. A carton of eggs hit $7 in some markets. Chicken doubled. Flour and oil jumped. Once prices reached their new plateau, retailers didn’t reintroduce discounts—they normalized them.

Why? Because consumers adapted faster than lawmakers.

If people will pay $3.79 for bread, why ever return to $1.99?

The Grocery Price Ratchet

Inflation works like a ratchet wrench:

-

Easy to tighten upward.

-

Nearly impossible to loosen downward.

Wholesale disruptions became permanent consumer expectations:

-

People assumed groceries were expensive → retailers locked in margins.

-

Consumers felt powerless → corporations felt justified.

-

Budgets adapted → marketing departments shifted price anchors.

A 2025 study by FMI (Food Industry Association) found that the majority of grocery chains did not lower prices even when commodity costs moderated. They blamed “labor, transportation and shrink”—a fancy way of saying we like profits where they are.

Families didn’t buy premium salmon and wine; they bought rice, pasta, canned protein, discount chicken. And yet the bill remained higher than pre-2021 levels.

People did everything “right”—couponing, budget shopping, buying generic—

and still lost ground.

3. Insurance, Utilities, Car Insurance — The Silent Killers

If groceries punched Americans in the face, the insurance sector kicked them while they were down.

In 2025, U.S. car insurance premiums soared over 18% year-over-year.

Not luxury policies—basic commuter cars in average zip codes.

Auto insurers blamed:

-

Rising repair costs

-

Increased accidents

-

More expensive vehicles to fix

-

Labor shortages in body shops

To the consumer, the story was simpler:

“I didn’t crash my car. Why am I paying more?”

Utilities Followed the Same Path

Electricity and water rates ballooned, especially in states investing in:

-

Data centers for cloud computing

-

AI training energy needs

-

Climate infrastructure

-

Grid modernization

None of those costs ever go backwards.

Meanwhile, power companies posted record profits.

On top of that, health insurance—already a uniquely American strain—rose 7–12% depending on the plan. Deductibles climbed. Co-pays rose. Prescription costs ballooned.

Americans absorbed the economic pain silently:

-

skipping dentist visits

-

delaying checkups

-

choosing urgent care over primary care

-

crowdfunding medical emergencies

The “inflation is cooling” narrative looked absurd to any parent paying a $1,300 insurance premium for a healthy family or a $9,000 deductible for a single surgery.

4. Wage Gains vs Real Consumption: Why Raises Didn’t Matter

Here’s another disconnect:

Economists point to average wage increases to argue that workers are “better off.”

But wages are linear, while living costs are compound.

A 5% raise doesn’t matter if:

-

your rent jumps 12%

-

groceries are up 15%

-

utilities are up 20%

-

your car insurance is up 30%

It feels like running up a sand dune:

You move, but the ground slides beneath you.

Real Purchasing Power Collapsed

American purchasing power isn’t measured by how much you make—

but how many meaningful things you can buy.

If $68,000 used to afford:

-

a two-bedroom apartment

-

a modest vacation

-

a savings cushion

…and now buys:

-

a one-bedroom

-

rising insurance

-

groceries

that person is objectively poorer.

This is why 2025 was not a recession, but a demotion.

A middle-class demotion.

5. Voices from the Ground: What Americans Actually Said

Quotes hit harder than charts.

Below are the kinds of comments Americans made online, at town halls, in classrooms, and in community meetings.

“Inflation went down, but the prices never did.”

— Single mom, Cleveland

“I don’t want to buy a house. I just want a month without panic.”

— Warehouse technician, Phoenix

“If milk goes from $3 to $6 and stays $6 forever, that’s not a ‘cooling.’ That’s a robbery.”

— Veteran, Tampa

“I work full-time, tutor, and drive Uber on weekends. That’s not ambition. That’s survival.”

— High school teacher, Indiana

“I’m not poor because of inflation. I’m poor because life refuses to get cheaper.”

— Graphic designer, Dallas

These aren’t dramatic statements—they’re rational responses to economic trauma.

6. The Psychology of Survival Economics

On paper, inflation cooling is a policy win.

In the real world, it’s an emotional loss.

Americans didn’t see relief.

They saw a final confirmation:

“The system will never return prices to normal. It will only protect corporations.”

This triggered three psychological shifts:

A. Brand distrust

Americans abandoned loyalty:

-

Legacy grocery brands → store brands

-

Subscription services → cancellation waves

-

Big banks → credit unions

-

Commercial news → local creators

B. Economic defensiveness

People began hoarding:

-

cash

-

canned goods

-

side gigs

-

emergency savings

-

remote work skills

This wasn’t paranoia.

It was rational resilience.

C. Loss of optimism

People stopped planning big.

They focused on what fit in their hands:

-

paying off one credit card

-

moving to cheaper states

-

taking $15k/year side hustles

-

saying “no” to debt

The American Dream didn’t vanish.

It simply shrunk to fit survival.

7. Predictions for 2026: How Inflation Will Behave

Here is the uncomfortable truth:

2026 will not be defined by falling inflation.

It will be defined by stubborn prices.

Three likely outcomes:

1. Prices plateau at post-crisis levels

Food, utilities, premiums—none will revert.

The “new normal” is the old expensive.

2. Behavioral recession

Consumers won’t cut because they’re weak;

they’ll cut because they’re smart.

2026 will reward:

-

minimalism

-

thrift

-

refurbished markets

-

local co-ops

-

community economics

3. The two-tier economy intensifies

Wealthy households will adapt with:

-

concierge care

-

private schools

-

tax optimization

-

AI leverage

Everyone else will adapt with:

-

roommates

-

side hustles

-

geographic arbitrage

-

subscription avoidance

The story of inflation is no longer about data.

It’s about strategy.

Conclusion: The Era of Emotional Economics

The U.S. economy in 2025 didn’t destroy wealth—it destroyed confidence.

It taught millions that:

-

Prices never fall once they rise.

-

Corporations don’t lower margins voluntarily.

-

Inflation measures speed, not fairness.

Americans didn’t feel poorer because they misunderstood math.

They felt poorer because their lives proved it.

You can’t debate with receipts.

You can’t “fact-check” a $300 grocery bill.

You can’t gaslight a rent increase.

If 2026 has a lesson, it is this:

Survival isn’t an accident. It’s a strategy.

And Americans have finally, painfully, begun to learn it.

Who Is Jose Carranza-Escobar? The Third Suspected Arsonist In Los Angeles Fire Who Is Jose Carranza-Escobar? The Third Suspected Arsonist In Los Angeles Fire After a brush fire started in Pioneer Park, Azusa, California, police have arrested a man on suspicion of arson. He is a homeless man. The ... |

Why the United States Is the Richest Country in the World but Still Has So Many Homeless People Why the United States Is the Richest Country in the World but Still Has So Many Homeless People This article explores that system in a deep, objective, and practical way. It brings together real-world experience, data, expert insights, and the lived reality of ... |

The Hidden Homeless: Why Millions of Americans Are One Paycheck Away From Losing Everything The Hidden Homeless: Why Millions of Americans Are One Paycheck Away From Losing Everything This article takes a deeper look at who the hidden homeless really are, why this group is growing so fast, how close the average American ... |