Who’s Inside the $100 Billion Club? Meet the World’s 14 Richest Billionaires

|

| Super Rich Club |

The $100 Billion Club Hits Record High in 2025: Who Are the Ultra-Wealthy Shaping the Global Economy?

As of March this year, the exclusive "$100 Billion Club"—an elite group of billionaires with personal fortunes exceeding $100 billion—has swelled to 14 members, marking an all-time high and a notable rise from just eight members recorded during the same period last year. This rapid expansion highlights the accelerating accumulation of wealth among the world’s richest individuals.

In the past decade, global billionaires have seen their collective net worth soar by an average of 120%. Yet, members of the $100 billion club have outpaced this growth significantly, with their fortunes ballooning by a staggering 255%. These returns far exceed benchmarks such as the S&P 500 index, which has climbed over 182%, and global inflation, which stands above 32% during the same period.

Collectively, the assets held by these 14 billionaires total an astonishing $2 trillion USD, meaning that this ultra-wealthy group, representing just 0.5% of the world’s 2,781 billionaires, now controls roughly 14% of all billionaire-held wealth globally.

From Modest Beginnings to an Era of Mega-Fortunes

When Forbes debuted its inaugural global billionaires list in 1987, the highest net worth belonged to two Japanese business magnates, each holding assets slightly above $10 billion—equivalent to about $27 billion in today’s dollars. Interestingly, such a figure would only secure a modest 69th place on the 2024 billionaire ranking, underscoring how dramatically global wealth concentration has escalated.

The rise of the $100 billion threshold was once unthinkable. It wasn’t until the dot-com bubble of 1999 that Microsoft co-founder Bill Gates became the first person to cross that milestone, temporarily, as a surge in Microsoft stock catapulted his net worth above $100 billion. However, the financial crash that followed nearly halved his wealth.

For nearly two decades, Gates remained the only member of the $100 billion club. Even as financial markets rebounded before and after the Great Recession, no other billionaire came close to matching him—until Jeff Bezos shattered that ceiling in 2017. As Amazon's valuation soared past $1 trillion, Bezos officially became the second member of this exclusive group.

It wasn’t until 2021, amid tech stock booms and a surge in consumer spending on luxury goods, that others such as Elon Musk and Bernard Arnault joined the ranks, cementing the club as a fixture of modern wealth.

Bernard Arnault Leads the Pack in 2025

At the top of the list today stands Bernard Arnault, CEO and chairman of luxury powerhouse LVMH. With a jaw-dropping net worth of $233 billion, Arnault retains his position as the wealthiest individual in the world. LVMH posted a net profit of $16.5 billion on revenues of $94 billion last year, reflecting the resilience of the luxury market despite global economic uncertainties.

In January, Arnault made headlines by unveiling his succession plan, aiming to secure LVMH’s long-term future under family control. His two eldest sons, Alexandre and Frédéric, joined siblings Delphine and Antoine Arnault on the company’s board of directors, solidifying the family’s grip on the empire.

Buffett and Bettencourt Meyers: The Outliers in the Club

The club’s oldest member, Warren Buffett, chairman of Berkshire Hathaway, continues to defy expectations at age 93. With a fortune currently valued at $133 billion, Buffett saw Berkshire’s stock rise 30% over the past year, hitting an all-time high earlier in 2025. Buffett's commitment to long-term value investing and philanthropy continues to make him one of the most respected figures in global finance.

Meanwhile, at the threshold of joining this ultra-elite circle is Francoise Bettencourt Meyers, heiress to the L’Oréal fortune. With an estimated net worth of $99.5 billion, she is poised to make history as the first woman to enter the $100 billion club. Her wealth has surged by nearly $29 billion since the start of 2023, driven by L’Oréal’s strong financial performance and global expansion.

The Bigger Picture

The expansion of the $100 billion club is more than just a headline-grabbing milestone. It reflects broader trends in global wealth distribution, industry dominance (particularly in tech and luxury sectors), and the power of equity markets. As the concentration of wealth intensifies, debates about inequality, taxation, and the responsibilities of the ultra-wealthy are likely to grow louder.

Whether this group will continue to grow or consolidate will depend on factors such as market volatility, corporate leadership, and geopolitical shifts. However, one thing is clear: the influence of these 14 billionaires extends far beyond their balance sheets, shaping industries, policies, and even cultural trends worldwide.

U.S. vs. Europe vs. Asia: Where Are the World’s Richest Concentrated?

While the $100 billion club has grown to 14 members globally, there are clear geographic patterns in where these ultra-wealthy individuals are based.

United States: The Powerhouse of Billionaires

The United States continues to dominate the club, accounting for over half of its members. Titans like Jeff Bezos, Elon Musk, Warren Buffett, Larry Ellison, and Mark Zuckerberg are emblematic of America’s tech-driven billionaire culture. The rise of Silicon Valley and its ecosystem of venture capital, innovation, and risk-taking has propelled many U.S.-based entrepreneurs into the $100 billion stratosphere.

American billionaires are largely concentrated in sectors like technology, financial services, and media, where disruptive business models and rapid scalability have enabled astronomical valuations. Companies such as Amazon, Tesla, Meta, and Berkshire Hathaway are key engines behind the U.S.’s billionaire surge.

Europe: The Reign of Luxury and Tradition

In contrast, Europe’s billionaires in the $100 billion club primarily owe their wealth to the luxury and consumer goods sectors. Bernard Arnault (LVMH) and his European peers have capitalized on global demand for high-end products and heritage brands.

Unlike the tech-heavy focus of U.S. billionaires, European billionaires such as Arnault and Amancio Ortega (Inditex, parent company of Zara) are deeply entrenched in fashion, retail, and luxury markets. Family business structures, generational wealth transfer, and a focus on tangible assets such as real estate and traditional industries are common themes in Europe’s wealth narrative.

Asia: Rising Giants but Slower Entry to the Club

Asia, despite producing a growing number of billionaires in the past decade, has yet to make a significant mark on the $100 billion club. While Chinese tech moguls like Jack Ma (Alibaba) and Pony Ma (Tencent) saw explosive wealth growth during the 2010s, regulatory crackdowns, economic headwinds, and market volatility have slowed their trajectory.

Asia’s wealth landscape is largely shaped by tech, e-commerce, and manufacturing, with rising stars from India and Southeast Asia gaining momentum. However, none have yet breached the $100 billion mark as of 2025, though experts predict that India’s Mukesh Ambani (Reliance Industries) or Gautam Adani could be strong contenders in the coming years, especially given India’s booming economy and rapid industrialization.

Global Dynamics and Wealth Distribution

The concentration of $100 billion club members in North America and Europe underscores the structural advantages in these regions—stable financial markets, robust corporate governance, and access to global capital flows. However, the future could see greater diversification as Asian economies mature and wealth creation shifts eastward.

Additionally, trends like the rise of sustainable investing, AI-driven business models, and luxury consumption in emerging markets could pave the way for new entrants from outside traditional powerhouses.

Conclusion

The $100 billion club’s evolution reflects deeper economic realities: technology continues to drive U.S. wealth creation, Europe’s luxury brands remain resilient, and Asia’s potential is steadily rising. As this ultra-exclusive club grows, it will continue to reshape global financial dynamics, investment trends, and even influence societal conversations about inequality and responsibility in the age of mega-fortunes.

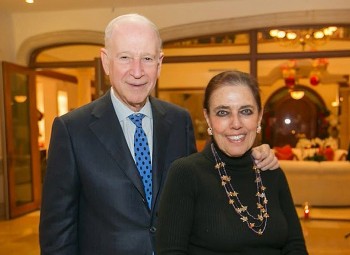

Top 5 Richest Doctors in the World - Path to Become Billionaires Top 5 Richest Doctors in the World - Path to Become Billionaires In North America and Europe, healthcare professionals can earn enormous incomes, but very few doctors go on to become billionaires. |

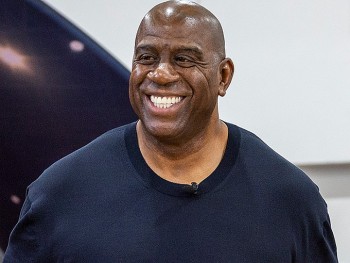

Top 4 Richest Sports Stars in the World Top 4 Richest Sports Stars in the World Magic Johnson, the former American basketball star, has just joined Michael Jordan, LeBron James, and Tiger Woods on the list of world billionaires. |

Top 10 Youngest Self-Made Billionaires in the World Today (Under 35) Top 10 Youngest Self-Made Billionaires in the World Today (Under 35) Based on the most recent rankings published by Forbes Magazine, the majority of the youngest billionaires globally are heirs. But there are also a lot ... |