Will Gold Reach $5,000—or Even $10,000 per Ounce? A Deep Dive into the Future of Gold

Gold Fever 2025: Why Experts See $4,500 Ahead Gold Fever 2025: Why Experts See $4,500 Ahead Gold is soaring past $3,200 an ounce in 2025—and analysts aren’t surprised. With global tensions rising and central banks hoarding gold, experts now predict the ... |

The Gold Rush of 2025: What’s Really Driving Prices to Uncharted Highs? The Gold Rush of 2025: What’s Really Driving Prices to Uncharted Highs? Not Just Another Gold Spike! Gold has gone into overdrive. Prices have soared past $3,240 per ounce—a historic high that’s shaking up global markets |

|

| Is gold still a good investment in 2025 and beyond |

Gold Isn’t Just a Metal—It’s a Signal

Gold has always been more than shiny metal. It's a measure of trust—or lack thereof—in the global financial system. When institutions falter, fiat currencies weaken, or inflation spirals, capital gravitates toward gold. Today, as markets grow more volatile and debt levels explode, a critical question looms:

Could gold soar to $5,000… or even $10,000 per ounce in the coming years?

This is no longer fringe speculation. Many serious investors and economists are treating these price levels as plausible milestones, not fantasies.

Why $5,000 Gold Is Within Reach

1. Unprecedented Monetary Expansion

The global money supply has grown faster in the past decade than in any comparable period. As central banks continue to monetize debt and print currency to stimulate economies, gold becomes a natural hedge against fiat debasement.

2. Central Bank Gold Accumulation

In 2023 and 2024, central banks set historical records for gold purchases. Nations like China, India, and Russia are quietly de-dollarizing, converting FX reserves into physical gold to hedge against U.S. geopolitical leverage. This steady accumulation creates a structural price floor.

3. Global Sovereign Debt Crisis Brewing

Advanced economies are sitting on top of unsustainable debt-to-GDP ratios. If bond markets lose confidence, central banks may be forced to suppress yields indefinitely. That’s bullish for gold, which thrives in low or negative real interest rate environments.

4. De-Dollarization and Currency Fragmentation

The U.S. dollar’s role as the global reserve currency is under challenge. BRICS nations are already exploring alternative trade settlement systems, many backed in part by gold. If gold re-emerges as a monetary anchor, its repricing could be dramatic.

What Would It Take for Gold to Reach $10,000?

Let’s be clear: $10,000 gold is not an investment forecast. It’s a systemic risk scenario.

But it's not fantasy either.

Consider These Catalysts:

-

Currency collapse in a major economy (e.g., hyperinflation, sovereign default)

-

A gold-backed digital currency system (central bank digital currencies tied to gold reserves)

-

A loss of trust in central banking and fiat money entirely

-

Revaluation event: If central banks declare gold a core monetary asset again (as part of a reset), prices may need to rise to reflect real reserves. Some models show gold would need to be $10,000–$15,000/oz to fully back existing money supply.

How Serious Investors Are Positioning

1. Physical Gold for Wealth Insurance

High-net-worth individuals are increasing allocations to physical gold in private vaults—not ETFs. Why? Because if the financial system experiences a liquidity freeze, paper claims may be meaningless.

2. Gold Mining Equities

If gold hits $3,000–$5,000, quality miners could see exponential gains. The leverage in gold stocks is real—but so is the risk. Selectivity is key.

3. Global Diversification

Smart investors are not only buying gold—they’re moving gold to geopolitically stable jurisdictions, ensuring access in case of capital controls or asset freezes.

Headwinds That Could Cap Gold’s Rise

Not every path leads to $10,000 gold. Consider these moderating forces:

-

A strong U.S. dollar supported by rising interest rates could suppress gold temporarily.

-

A soft landing in global economies might reduce urgency for safe havens.

-

Bitcoin and digital assets may continue to siphon capital from gold, especially among younger investors.

Still, these are cyclical variables. The underlying structural and monetary pressures are building, making gold a strategic long-term play.

Frequently Asked Questions (FAQs)

Q1: Is gold still a good investment in 2025 and beyond?

Yes. In an environment of debt, inflation, and monetary instability, gold remains a low-correlation asset with intrinsic value and no counterparty risk.

Q2: Should I wait for a pullback to buy gold?

Timing the market is hard. Instead, consider dollar-cost averaging into gold over time to reduce volatility.

Q3: Can Bitcoin replace gold as a store of value?

Bitcoin offers potential, but gold has 5,000 years of history, institutional trust, and isn't reliant on electricity or internet access. In black swan events, gold remains more reliable.

Q4: What happens to gold if inflation falls?

Even in disinflationary environments, gold can rise if real interest rates remain low or geopolitical risk increases.

Q5: How much gold should I own in a portfolio?

Most financial planners recommend 5–15% allocation, depending on your risk profile, time horizon, and views on systemic risk.

Conclusion: Gold Is Not a Trade—It’s a Lifeboat

Whether gold hits $5,000 or $10,000 isn’t the real question. The real question is: How fragile is the global financial system—and how prepared are you?

Gold may not deliver massive returns quickly. But in a world of rising uncertainty, it remains one of the few assets with no counterparty risk, no default risk, and no expiration date.

If you’re looking for long-term resilience—not just returns—gold may be the anchor your portfolio needs.

Top 10 Countries with the Largest Gold Reserves in the World 2025 Top 10 Countries with the Largest Gold Reserves in the World 2025 Discover the top 10 countries with the largest gold reserves in 2025. Updated rankings, official data, and expert insights reveal how nations use gold to ... |

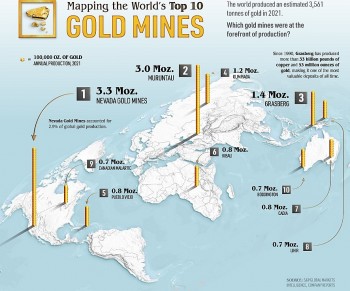

Gold Fever: Top 11 Largest Gold Mines in the World, By Production Gold Fever: Top 11 Largest Gold Mines in the World, By Production As of 2025, there are more than 1,300 active gold mines operating globally. But where exactly are the world’s most productive gold mines located today? |

Top 5 Largest Gold Mines in Vietnam: Reserves, Status, and Economic Impact Top 5 Largest Gold Mines in Vietnam: Reserves, Status, and Economic Impact Below is an expert-curated ranking of the Top 5 Largest Gold Mines in Vietnam—based on total reserves, historical output, and economic relevance—updated 2025. |