Retirement Age Changes in 2026: Claiming Social Security at 62, 67, or 70?

|

| Claiming Social Security at 62, 67, or 70 After 2026: What the Numbers Show |

For decades, Americans have casually said, “You get full Social Security at 65” or “around 66.” In 2026, that shortcut can quietly cost you thousands of dollars over retirement.

Starting in 2026, a long-planned shift fully takes effect: full retirement age under Social Security is 67 for a major group of retirees. The rule itself isn’t new, but the year 2026 is when many Americans finally collide with it in real life.

If you’re approaching retirement, or even in your late 50s, understanding this change is no longer optional. It affects when you should claim, how much you’ll receive every month, and whether working while collecting benefits will reduce your check.

Read more:

- Can You Retire Before 67? How Early Social Security Cuts Your Monthly Check

- Which U.S. States Will See the Biggest Boost in Social Security Payments in 2026?

What “full retirement age” really means

Under Social Security, you can start retirement benefits as early as 62. But the age that determines whether you receive 100% of your earned benefit is called full retirement age (FRA).

-

Claim before FRA → permanent reduction

-

Claim at FRA → full benefit

-

Claim after FRA (up to 70) → permanent increase

In short, FRA is the financial “neutral point” of Social Security.

The 2026 change in one clear sentence

From 2026 onward, anyone born in 1960 or later has a full retirement age of 67.

That’s the final step in a gradual increase that began decades ago. Earlier generations saw FRA move from 65 to 66 and then inch upward. The 1960 birth year is where the increase stops.

Who this affects most

-

People turning 62 in 2026

-

People turning 66 in 2026 and assuming that means “full” benefits

-

Anyone born 1960 or later planning their retirement timeline

Full retirement age by birth year (quick reference)

| Birth year | Full retirement age |

|---|---|

| 1959 | 66 and 10 months |

| 1960 or later | 67 |

If you were born in 1960 or later, 66 is no longer “full retirement age.”

Claiming options when your FRA is 67

Once you understand that 67 is the benchmark, the next step is deciding when to claim.

How claiming age affects your monthly check

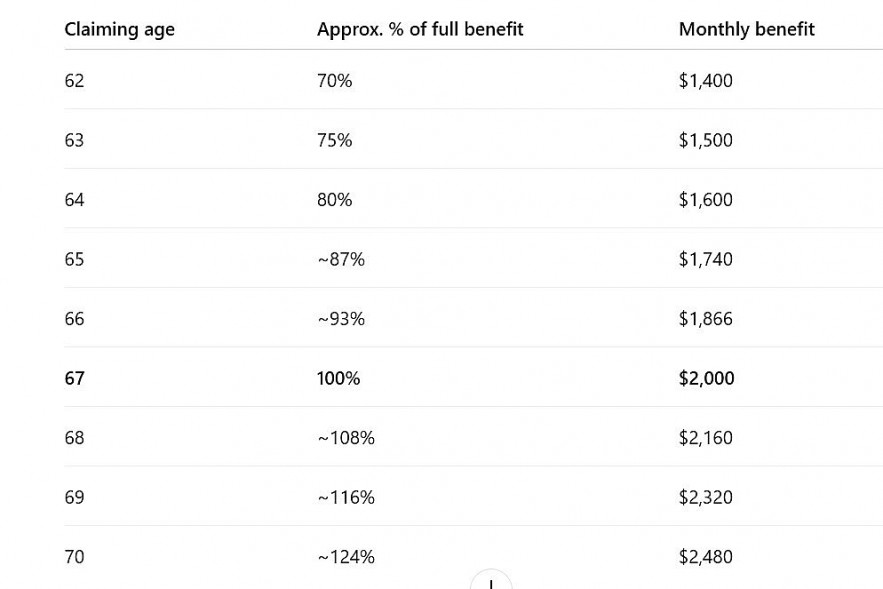

If your full benefit at 67 is $2,000 per month, here’s how timing changes the amount:

|

| How claiming age affects your monthly check |

Two things matter here:

-

Reductions for early claiming are permanent

-

Increases for delaying stop at age 70

Example 1: Born in 1960 and turning 66 in 2026

This is one of the most common and costly misunderstandings.

-

Birth year: 1960

-

Age in 2026: 66

-

Full retirement age: 67

If you claim at 66 thinking you’re getting “full Social Security,” you’re actually claiming early.

-

Full benefit at 67: $2,000/month

-

Benefit at 66: about $1,866/month

That’s roughly $134 less every month, for life.

Over 20 years of retirement, that’s more than $32,000 in today’s dollars, before cost-of-living increases are even considered.

Example 2: The classic 62 vs. 67 vs. 70 decision

Assume your full benefit at 67 is $2,200 per month.

-

Claim at 62 → about $1,540/month

-

Claim at 67 → $2,200/month

-

Claim at 70 → about $2,730/month

The gap between 62 and 70 is nearly $1,200 per month.

Early claiming gives you income sooner, but delayed claiming provides stronger protection later in life, when savings may be lower and healthcare costs higher.

Working while collecting Social Security in 2026

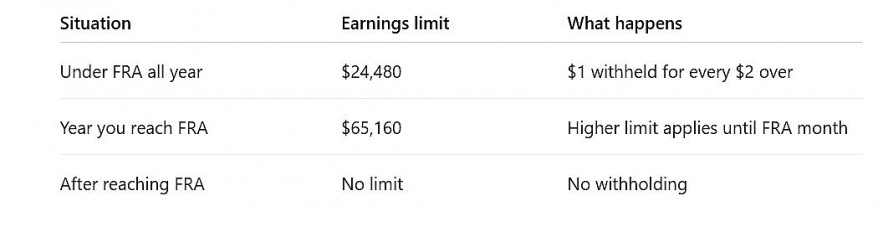

Another area where people get surprised is the earnings test.

If you claim benefits before full retirement age and continue working, Social Security may temporarily withhold part of your benefit.

2026 earnings limits

|

| 2026 earnings limits |

Example 3: Claim early and keep working

-

Age: 63 in 2026

-

Claimed Social Security

-

Job income: $35,000

Calculation:

-

Earnings limit: $24,480

-

Amount over limit: $10,520

-

Benefits withheld: about $5,260

Important nuance:

This money isn’t always “lost forever.” Once you reach full retirement age, Social Security recalculates your benefit to credit back months that were withheld. Still, the cash-flow hit can be real, and many people don’t plan for it.

Example 4: The year you turn 67

The year you reach full retirement age has special rules.

-

The higher earnings limit applies

-

Only income before the month you turn 67 counts

That’s why some people:

-

Work most of the year

-

Start benefits in the month they turn 67

-

Avoid most or all withholding

Timing matters more than many people realize.

Common myths about the 2026 change

Myth 1: “Social Security retirement age is going up again.”

No. The move to 67 was scheduled long ago. 2026 is simply when the last group reaches that rule.

Myth 2: “I can claim early and fix it later.”

Early claiming generally locks in a lower benefit. While there are limited withdrawal options, most people should assume early means permanent.

Myth 3: “If I work, Social Security punishes me.”

The earnings test only applies before full retirement age. After 67, you can earn any amount without benefit reductions.

Practical guidance: choosing the right age for you

There’s no single “best” claiming age, but there are patterns.

Claim earlier may make sense if:

-

You need income immediately

-

You have limited savings

-

You have health concerns or shorter life expectancy

Claiming at 67 works well if:

-

You want simplicity

-

You’re still working part-time

-

You want to avoid permanent reductions

Delaying to 70 may be smart if:

-

You expect to live into your 80s or beyond

-

You want higher guaranteed income later

-

You’re protecting a spouse who may rely on survivor benefits

Why this matters more than ever

For many retirees, Social Security is:

-

The largest guaranteed income source

-

Inflation-adjusted

-

Paid for life

A decision made at 62 or 66 echoes for decades. The 2026 milestone forces many Americans to confront that reality head-on.

Bottom line

From 2026 forward, “full retirement age” means 67 for anyone born in 1960 or later.

Claiming earlier means smaller checks for life. Waiting longer means larger checks, but fewer years of payments.

The right choice depends on your health, work plans, savings, and family situation. What matters most is making the decision with clear eyes, not outdated assumptions.