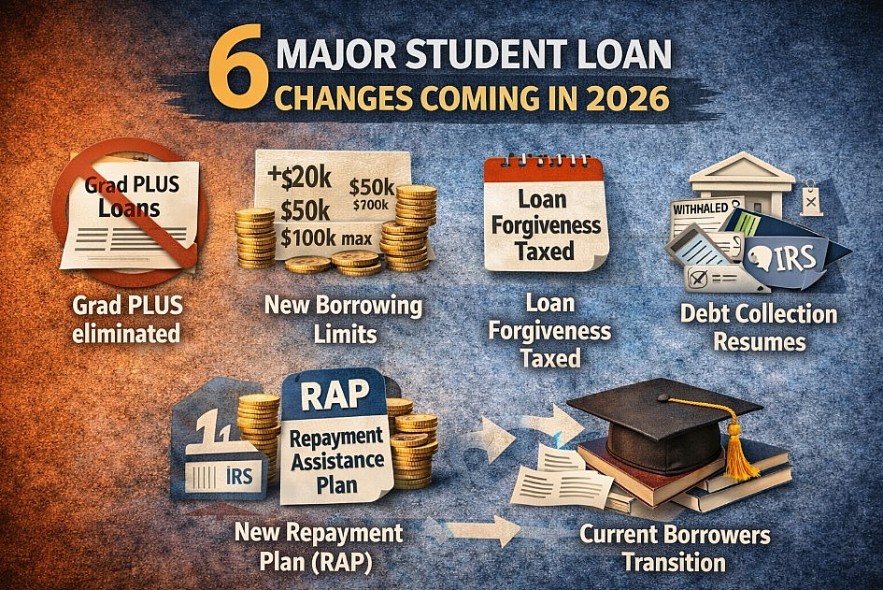

U.S Student Loans Will Look Very Different in 2026 - Here Are the 6 Biggest Changes

Beginning July 1, 2026, the U.S.student loan system will undergo its most significant overhaul in decades. New federal rules will change how much students and parents can borrow, how repayment works, and how loan forgiveness is taxed.

These changes will affect future students most, but current borrowers won’t be untouched.

Here are the six most important changes you need to understand — explained simply and clearly.

Read more: Student Loan Reform in America: Your College Costs and Debt Future

|

| Student Loans Are Changing in 2026: 6 Rules That Will Reshape How Americans Borrow and Repay |

1. Graduate PLUS Loans Will Be Eliminated

Starting in 2026, Graduate PLUS loans will no longer be available to new borrowers.

Until now, these loans allowed graduate and professional students to borrow up to the full cost of attendance. Their elimination marks a major shift away from virtually unlimited federal borrowing.

Why it matters:

Graduate students may need to rely more on personal savings, scholarships, employer support, or private loans.

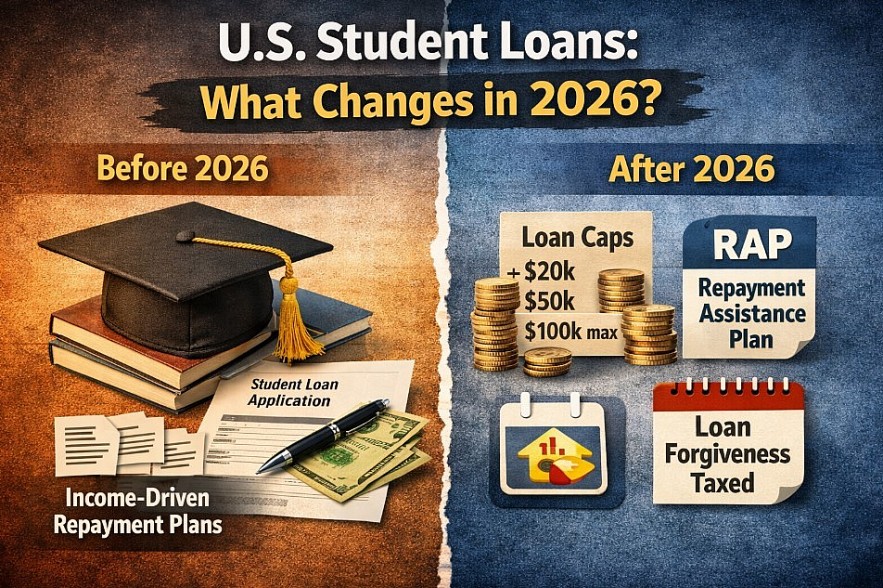

2. New, Lower Borrowing Limits for Graduate Students and Parents

Federal borrowing will now come with strict caps:

-

Graduate students:

-

$20,500 per year

-

$100,000 lifetime limit

-

-

Professional programs (law, medicine):

-

$50,000 per year

-

$200,000 lifetime limit

-

-

Parent PLUS loans:

-

$20,000 per year

-

$65,000 lifetime limit

-

Why it matters:

These caps are significantly lower than what many borrowers relied on in the past and could widen funding gaps for higher education.

Read more: Not to Pay 'Student Loans' for 2 Years, Get Forgiveness After 10 Years

3. A New Repayment System Replaces Most Income-Driven Plans

The current menu of Income-Driven Repayment (IDR) plans will be consolidated into a new option called the Repayment Assistance Plan (RAP).

Key features include:

-

Payments still based on income

-

Mandatory minimum payment of $10 per month

-

Repayment periods extending up to 30 years

Why it matters:

RAP is simpler, but less flexible than prior IDR plans, especially for low-income borrowers.

|

| Before You Borrow Another Dollar: 6 Student Loan Rules Changing in 2026 |

4. Loan Forgiveness Will Be Taxed Again

Temporary rules that made forgiven student loan balances tax-free will expire.

Starting in 2026:

-

Forgiven student loan debt will once again be treated as taxable income at the federal level.

Why it matters:

Borrowers nearing forgiveness could face large, unexpected tax bills — often called a “tax bomb.”

5. Stricter Collections Will Resume for Defaulted Loans

Federal enforcement actions paused during the pandemic will fully resume.

This includes:

-

Wage garnishment

-

Seizure of tax refunds

-

Reduced access to deferment and forbearance

Why it matters:

Borrowers in default face higher financial risk if they don’t reenter good standing before enforcement restarts.

6. Current Borrowers Will Eventually Be Transitioned

Borrowers already in repayment may keep their existing plans temporarily, but many will be required to transition to RAP over time.

Why it matters:

Even borrowers who took loans years ago should prepare for future changes to their monthly payments.

What This Means Overall

The 2026 reforms signal a clear shift in U.S. student loan policy:

-

Less federal borrowing

-

Fewer repayment options

-

Greater long-term responsibility placed on borrowers

For students, parents, and graduates, early planning has never mattered more.