Gold vs Silver vs Copper: Same Rally, Different Drivers

Will Gold Reach $5,000—or Even $10,000 per Ounce? A Deep Dive into the Future of Gold Will Gold Reach $5,000—or Even $10,000 per Ounce? A Deep Dive into the Future of Gold Could gold reach $5,000 or even $10,000 per ounce? Explore expert forecasts, economic drivers, central bank activity, and how to prepare for a potential gold ... |

What Is Silver and Why Is It So Valuable? A Complete Guide as Prices Surge Toward $80 What Is Silver and Why Is It So Valuable? A Complete Guide as Prices Surge Toward $80 As silver prices approach a historic $80 level, investors are asking a basic question again: what exactly is silver, and why does this metal still ... |

|

| Gold vs Silver vs Copper: Price Comparison and Market Drivers |

Metals Rally Together — But Not for the Same Reasons

As 2025 winds down, three key metals — gold, silver, and copper — are all grabbing headlines. Yet while they’re trading near multi-year highs, the stories behind their prices are very different.

Understanding the nuances matters for investors who want to position their portfolios smartly heading into 2026.

Here’s where they stand as of December 30, 2025:

▪ Gold: ~$4,340–$4,344 per ounce (spot/futures trading) after profit-taking from recent highs.

▪ Silver: ~$70–$72 per ounce, also pulling back from brief record peaks above $80/oz.

▪ Copper: ~$5.52–$5.59 per pound (~$12,000+ per tonne on LME), still elevated after a steep 2025 climb.

These prices reflect a rare alignment: all three metals have seen strong demand drivers in the same year. But the reasons they rallied are not identical.

Read more:

-Will Copper Crash or Stay Elevated in 2026? Three Scenarios That Matter

- Copper Just Had a Historic Run. What’s Driving the Rally—and What Comes Next?

Gold: The Classic Safe Haven

Gold’s appeal is straightforward: when markets wobble and uncertainty rises, investors buy bullion.

In 2025, this dynamic was strong. Central bank buying, geopolitical frictions, and expectations of monetary easing all contributed to gold’s dramatic uptrend earlier in the year. Late-December profit-taking has trimmed some of those gains, but prices remain well above historical norms.

For retail investors, gold is less about industrial use and more about risk insurance — a hedge against inflation, currency moves, or macro shocks.

Key drivers for gold in 2025:

-

Safe-haven demand

-

Central bank accumulation

-

Monetary policy uncertainty

Silver: The Hybrid Metal

Silver sits between gold’s safe-haven role and copper’s industrial demand. In 2025 it briefly pierced levels above $80/ounce, buoyed by both investor interest and real industrial end-use.

Silver’s dual identity — part precious metal, part industrial input — means it reacts to both market sentiment and real economic activity. Its pullback to ~$70–72/oz reflects a mix of profit-taking and shifting investor focus as the year ends.

Why silver matters to investors:

-

It tends to amplify trends seen in gold

-

Industrial demand adds structural support

-

Price swings can be more extreme than gold

|

| Copper Prices Are Exploding After Gold and Silver. Here’s What’s Really Going On |

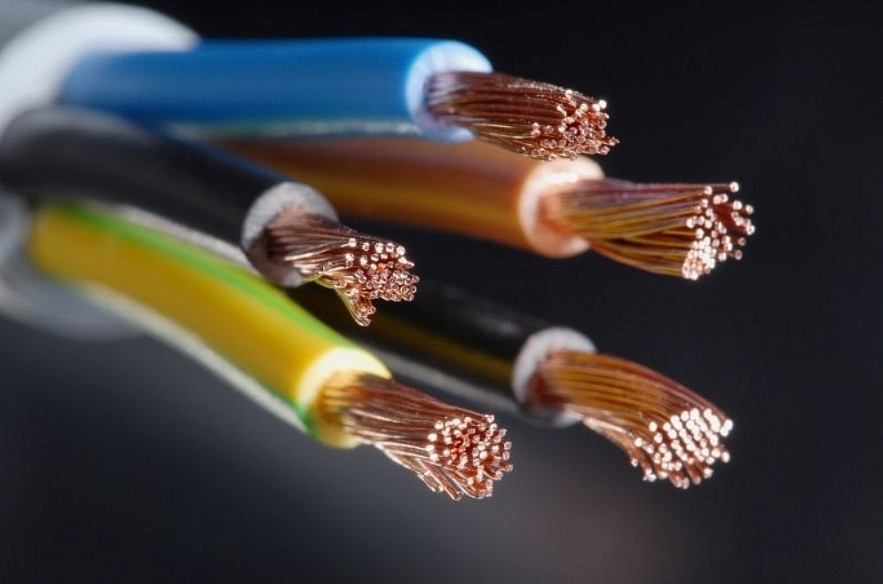

Copper: The Industrial Powerhouse

Unlike gold and silver, copper draws almost all of its value from industrial demand. It’s central to electricity infrastructure, renewable energy, and electric vehicles — sectors that have seen rapid expansion in 2025.

This year’s rally wasn’t just about cyclical demand. Structural forces — from power grid upgrades to EV adoption — combined with supply constraints, have driven copper prices to near historic levels.

Copper’s rise reflects the real economy: factories, utilities, and infrastructure — not just investor sentiment.

Copper rally drivers in 2025:

-

Electrification and grid investment

-

EV and renewable energy demand

-

Tight supply and inventory dislocations

Why They Don’t Move the Same Way

Even when all three metals rally together, don’t assume they’ll continue to behave identically:

Gold often moves on macro sentiment — fear or safety.

Silver reacts to both macro and industrial signals.

Copper mostly tracks real-world economic activity and capital spending.

That makes copper less about short-term speculation and more about long-term trends in energy and infrastructure.

For example, while gold and silver pulled back slightly in late December on profit-taking and easing risk sentiment, copper remained elevated — reflecting ongoing industrial demand rather than flight-to-safety behavior.

What This Means for Investors

Here’s how you might think about these metals heading into 2026:

Gold: Still relevant as a hedge, especially if uncertainty persists.

Silver: Consider as a tactical play — can magnify trends but also swings.

Copper: A strategic industrial play linked to energy transition themes.

Each metal tells a different story — and mixing them thoughtfully in a portfolio can balance safety with growth exposure.

Price Comparison

| Metal | Approx. Price (US) | Primary Driver |

|---|---|---|

| Gold | ~$4,340–$4,344/oz | Safe haven, central bank demand |

| Silver | ~$70–$72/oz | Precious + industrial demand |

| Copper | ~$5.52–$5.59/lb | Industrial activity, supply tightness |

Key Facts & Sources

-

Gold is trading above $4,300 an ounce late December after a prolonged rally and recent profit-taking.

-

Silver briefly exceeded $80/oz in late 2025 before pulling back near $70–72/oz.

-

Copper remains strong at ~$5.5/lb (~$12,000/tonne), driven by industrial demand and tight supply.