Social Security COLA 2026 Forecast: Bigger Raise Ahead — But Will Retirees Feel It?

When Do Social Security Payments Go Out in May? The Full 2025 Payment Schedule When Do Social Security Payments Go Out in May? The Full 2025 Payment Schedule |

Why Social Security Payments Are Being Suspended in 2025 - and How to Restore Them Why Social Security Payments Are Being Suspended in 2025 - and How to Restore Them |

|

| The Social Security Administration will release the official number in mid-October 2025 |

What Is COLA and Why It Matters

The Cost-of-Living Adjustment (COLA) is an annual increase in Social Security and Supplemental Security Income (SSI) benefits. Its purpose is to help recipients maintain their purchasing power despite inflation. COLA is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), specifically comparing data from the third quarter (July through September) of the current year to the same period the year before.

For retirees and others on fixed incomes, COLA is a critical tool. It helps ensure that benefits keep pace with inflation, especially for essential goods and services like food, housing, and medical care.

The 2026 Forecast: A Closer Look

Recent estimates suggest that the 2026 COLA will be approximately 2.7% to 2.8%. This would be slightly higher than the 2.5% adjustment seen in 2025 but well below the historically high 8.7% adjustment in 2023. While the exact figure will not be finalized until October 2025, these early forecasts provide a useful planning reference.

This anticipated increase reflects persistent, though moderate, inflation. While prices are not rising at the same breakneck pace as they did in 2022 or 2023, the cost of essentials continues to creep upward, keeping pressure on household budgets.

What a 2.7% Increase Means in Dollars

To put the forecasted increase in perspective:

-

The average Social Security retirement benefit in 2025 is around $2,008 per month.

-

A 2.7% COLA would translate to an increase of about $54 per month.

-

The new monthly benefit would then rise to approximately $2,062.

For those receiving disability or survivor benefits, which typically involve lower base amounts, the dollar increase would be smaller. Couples where both spouses receive benefits could see a combined increase of around $100 to $110 per month, depending on their individual benefit amounts.

Rising Costs That May Offset the COLA

While the projected COLA sounds encouraging, several key expenses could absorb much of the benefit:

Medicare Part B Premiums

Medicare Part B premiums are expected to rise significantly in 2026, potentially reaching around $206.50 per month. That’s an increase of more than $20 from 2025. Because these premiums are automatically deducted from Social Security checks, retirees will see a smaller net increase in their take-home benefits.

Healthcare Costs

Beyond premiums, out-of-pocket medical expenses—including prescription drugs, co-pays, deductibles, and long-term care—are rising faster than general inflation. Medical inflation remains one of the biggest financial burdens for retirees.

Housing, Utilities, and Food

The cost of housing, whether through rent, property taxes, or maintenance, continues to climb in many parts of the country. Add in rising utility bills and food prices, and it's clear that many retirees are facing expenses that outstrip their annual COLA.

Taxes and Income-Based Premiums

Higher Social Security benefits can sometimes push retirees into higher tax brackets or trigger income-related Medicare surcharges (IRMAA). These surcharges apply to Part B and Part D premiums and can significantly reduce the net benefit for middle- and higher-income retirees.

Net Effect: What Retirees May Actually See

After accounting for these deductions and cost increases, the average retiree may only see a net increase of $30 to $35 per month from the 2026 COLA. While every bit helps, this modest gain is unlikely to fully offset the rising cost of essentials.

COLA Trends Over Time

Putting the 2026 forecast into historical context helps explain its implications:

-

2023: 8.7% (highest in 40 years)

-

2024: 3.2%

-

2025: 2.5%

-

2026 (forecast): 2.7% to 2.8%

The average COLA over the past 20 years has hovered around 2.6%. The 2026 estimate falls squarely within this range. However, many retirees argue that the CPI-W index underrepresents their actual spending, especially since it does not weigh healthcare and housing costs as heavily as retirees experience them.

Important Dates to Watch

-

September 2025: Final CPI-W inflation data is released.

-

October 15, 2025: The Social Security Administration announces the official 2026 COLA.

-

January 2026: New benefit amounts take effect.

During this window, retirees should monitor announcements, review Medicare premium changes, and adjust their financial plans accordingly.

What Retirees Can Do Now

1. Estimate Net Gains

Start by calculating your likely gross increase (2.7% of your current benefit) and subtract estimated Medicare premiums to get your expected take-home amount.

2. Review Your Budget

Focus on areas where costs are increasing the most: medical expenses, housing, groceries. Look for opportunities to reduce or delay spending in lower-priority areas.

3. Check Tax Impact

An increase in benefits may affect your federal and state taxes, or push you into a higher bracket for Medicare premiums. Speak with a tax advisor if you're unsure.

4. Explore Assistance Programs

Programs like Medicare Savings Programs (MSPs), Low Income Home Energy Assistance Program (LIHEAP), or Supplemental Nutrition Assistance Program (SNAP) can offer additional support.

5. Stay Informed

Stay up to date on inflation trends, COLA announcements, and Medicare changes by checking trusted sources or subscribing to retirement newsletters.

Long-Term Policy Considerations

The COLA debate is also part of a broader policy conversation. Critics argue that CPI-W doesn’t accurately reflect the spending habits of retirees and have pushed for using a CPI-E (Consumer Price Index for the Elderly), which more heavily weights healthcare and housing costs. While no major policy shift is imminent, it's a topic that continues to gain traction.

At the same time, the future solvency of Social Security remains uncertain. Increased COLAs add pressure to a system already expected to face funding shortfalls within the next decade. Balancing retiree protection with long-term sustainability will remain a top issue for lawmakers.

Conclusion: A Modest Boost, but Challenges Remain

The forecasted 2026 COLA offers a modest financial boost for millions of Americans who rely on Social Security. However, rising healthcare costs, housing expenses, and Medicare premiums will likely absorb much of that gain. Retirees should not assume the increase will meaningfully expand their buying power, but rather treat it as a tool to help maintain financial stability.

Planning ahead, tracking expenses, and staying informed are the best ways retirees can protect themselves in a time of persistent, if moderate, inflation. While the COLA system provides critical support, it's only part of the picture. The real work is in adapting budgets, leveraging assistance, and making smart decisions to preserve well-being in retirement.

Frequently Asked Questions (FAQs)

1. When will the 2026 Social Security COLA be announced?

The official announcement is expected on October 15, 2025.

2. What is the projected COLA for 2026?

Current estimates suggest a 2.7% to 2.8% increase in benefits.

3. How is COLA calculated?

It’s based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) from July to September compared to the same period the previous year.

4. Will my Medicare premiums reduce my COLA increase?

Yes. Medicare Part B premiums are deducted from Social Security benefits and are expected to rise in 2026, reducing the net benefit.

5. How much more money will I actually receive?

The average net gain is expected to be around $30 to $35 per month after accounting for Medicare and other deductions.

6. Does COLA keep up with inflation?

COLA helps, but it often falls short of fully offsetting inflation, especially in healthcare and housing.

7. What can I do to prepare for changes in 2026?

Review your budget, estimate your net increase, monitor Medicare costs, check for tax implications, and explore financial assistance programs if needed.

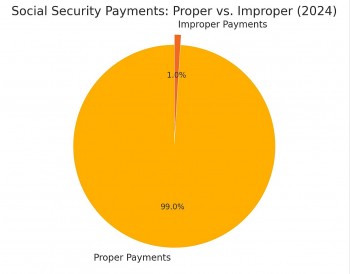

Social Security Fraud? The Truth Behind Trump and Musk’s Allegations Social Security Fraud? The Truth Behind Trump and Musk’s Allegations In recent months, allegations of widespread fraud within the U.S. Social Security program have emerged, notably from President Donald Trump and Elon Musk, head of ... |

Are Millions of Dead People Getting Social Security? Here’s What the Data Really Says Are Millions of Dead People Getting Social Security? Here’s What the Data Really Says Claim: Millions of deceased individuals are still receiving Social Security benefits. |

Social Security Overpayments: What They Are and How to Avoid Them Social Security Overpayments: What They Are and How to Avoid Them This article breaks down the causes, consequences, and solutions for Social Security overpayments—and what every recipient should know to avoid them. |

Major Changes to Social Security Identity Checks in April 2025 – How It Affects Your Benefits Major Changes to Social Security Identity Checks in April 2025 – How It Affects Your Benefits Starting March 31, 2025, the Social Security Administration (SSA) will roll out significant changes to its identity verification process for benefit claimants. |