The 2026 U.S. Economy Forecast: Prepare Now or Get Left Behind

US GDP shrank by -0.3% as Trump’s Trade War Bites US GDP shrank by -0.3% as Trump’s Trade War Bites |

AI in 2025 and the Great Divide: Why Those Who Used It Won — and How 2026 Will Accelerate the Split AI in 2025 and the Great Divide: Why Those Who Used It Won — and How 2026 Will Accelerate the Split |

A Turning Point for the American Economy

Every economic era has a defining moment. For the United States, 2026 is shaping up to be the year when the country’s financial, technological, and demographic pressures collide. After years of post-pandemic volatility — inflation spikes, interest-rate shocks, supply chain resets, AI breakthroughs, and geopolitical instability — Americans now face a radically different economic landscape.

The question is no longer whether the U.S. economy is changing.

The question is who will adapt — and who will be left behind.

The 2026 outlook reveals a nation in transition, moving toward a future where technological leverage, financial literacy, and adaptability determine economic survival. This report outlines the forces shaping the year ahead — and the strategies Americans need now to stay ahead.

|

| 2026 US economy forecast |

1. Inflation Is Cooling, but Prices Will Not Return to Pre-Pandemic Levels

Despite improving inflation metrics, Americans feel poorer than ever — and the data supports that sentiment. The U.S. economy has entered an era of sticky inflation, where prices stabilize but remain permanently elevated.

Why prices won’t drop in 2026:

-

Supply chains have been reordered around resilience, not cheapness.

-

Energy and commodity volatility persists due to geopolitical tensions.

-

Rent inflation remains high because of long-term housing shortages.

-

Labor costs continue rising as employers compete for scarce workers in key industries.

In other words:

Inflation falling does not mean affordability returning.

Households must plan for a “new normal” where groceries, utilities, childcare, and healthcare cost more every single year, even if inflation is officially under control.

2. Interest Rates Stay Higher for Longer — Reshaping Credit, Housing, and Business

The Federal Reserve’s aggressive tightening cycle changed the economic environment more profoundly than many expected. Even if the Fed begins gradual cuts, the era of near-zero interest rates is over.

2026 interest-rate expectations:

-

Mortgage rates likely stabilize between 5% and 6.5% — far above the 2–3% rates many homeowners locked in during 2020–2021.

-

Auto loans remain expensive, with average terms extending to 72–84 months.

-

Business borrowing stays tight, pressuring startups and small enterprises.

-

Credit card rates remain historically high, worsening household debt loads.

These higher-for-longer rates reshape the economy in three major ways:

A. Homeowners with low-rate mortgages won't move

This freezes the housing market and intensifies the inventory crisis.

B. Younger Americans struggle to enter homeownership

First-time buyers face higher prices, higher rates, and stricter lending conditions.

C. Small businesses face consolidation pressure

Companies unable to refinance or borrow cheaply become acquisition targets or close their doors.

The new credit environment rewards cash-rich households, disciplined savers, and businesses with efficient capital structures.

How Credit-Card Debt Became America’s Real Poverty Line How Credit-Card Debt Became America’s Real Poverty Line |

3. The Housing Divide Becomes a Defining Economic Fault Line

By 2026, the U.S. housing landscape will not be defined by buyers versus renters — but by mortgage generations.

Group 1: Homeowners locked into 2–3% mortgages

They enjoy artificially low housing costs and rising home equity. They dominate wealth accumulation through unrealized gains.

Group 2: Buyers entering at 6–8% rates

They face higher monthly payments, lower affordability, and limited refinancing options.

Group 3: Permanent renters

A growing class who may never buy due to down payment challenges, student loans, and stagnant wages.

This divide impacts:

-

geographic mobility

-

family planning

-

political behavior

-

intergenerational wealth

-

retirement security

For many Americans, housing is no longer an entry point to the middle class — it is the barrier.

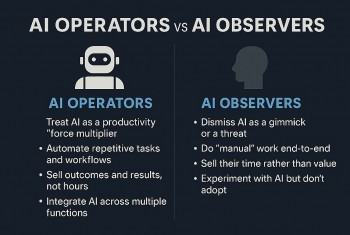

4. AI Reshapes Productivity, Wages, and Job Security

The most profound economic shift heading into 2026 is the acceleration of artificial intelligence adoption across all industries. The U.S. is moving from experimentation to large-scale integration.

A. AI eliminates tasks, not entire professions

Workers whose jobs rely on repetitive or predictable tasks — analysts, junior developers, administrative staff, paralegals, customer support agents — are most vulnerable.

B. Productivity surges for AI-literate employees

Workers who master AI tools can produce the output of 5–20 traditional employees, enabling:

-

higher wages

-

flexible work

-

micro-entrepreneurship

-

career acceleration

C. Companies re-evaluate workforce structures

Expect:

-

fewer middle managers

-

leaner teams

-

greater reliance on automation

-

cross-functional roles

-

AI-augmented decision making

D. A new labor divide emerges

The key distinction in 2026 is not college-educated vs. non-college.

It is AI-enabled vs. AI-excluded.

Wage gaps widen as those who embrace AI soar — and those who resist it stagnate.

5. The Labor Market Tightens in Some Industries but Weakens in Others

Despite fears of recession, the U.S. job market remains resilient — but polarized.

Sectors likely to expand in 2026:

-

Healthcare (aging population, chronic shortages)

-

Cybersecurity (AI-driven cyber threats)

-

Robotics maintenance (physical labor machines still require humans)

-

Data infrastructure and cloud services

-

Clean energy and grid modernization

-

Logistics and supply chain optimization

Sectors at risk of contraction:

-

Traditional administrative roles

-

Customer service centers

-

Retail and hospitality (automation)

-

Basic content production

-

Entry-level legal and financial research

The new rule of the labor economy:

If AI can do your work faster, cheaper, and at scale, you must learn to work with AI — or you’ll be replaced by someone who does.

How Americans Learned to Survive 2025 — and Win 2026 How Americans Learned to Survive 2025 — and Win 2026 |

6. Consumer Debt Reaches a Critical Threshold

Rising prices and stubbornly high interest rates pushed American households into record debt levels. By 2026, the warning signs will be impossible to ignore.

Key vulnerabilities:

-

Credit card interest rates above 20%

-

Delinquencies rising across auto loans

-

Student loans restarting payments

-

Younger Americans delaying life milestones

-

Senior citizens carrying higher debt into retirement

The risk is not a sudden crisis — but a slow erosion of financial stability across tens of millions of households.

7. Corporate America Faces a Year of Consolidation and Transformation

Major companies are already preparing for the 2026 economic environment. Expect:

A. Aggressive mergers and acquisitions

Cash-rich firms will acquire smaller competitors unable to survive the high-rate era.

B. AI replacing non-core corporate functions

Back-office roles, marketing departments, data entry teams, and early-career staff face reductions.

C. A new wave of entrepreneurship

Individuals leveraging AI tools launch:

-

automated e-commerce brands

-

niche consultancies

-

content-driven businesses

-

micro-agencies

-

digital product lines

The line between “worker” and “entrepreneur” will blur permanently.

8. Geopolitical and Trade Pressures Add Global Volatility

The U.S. economy in 2026 will not operate in isolation. Key global forces include:

A. U.S.–China tensions

Trade disputes, tech restrictions, and supply chain realignment continue.

B. Energy instability

Conflicts in the Middle East or Eastern Europe influence oil, gas, and shipping routes.

C. Reshoring of manufacturing

The U.S. accelerates production of critical technologies like chips, batteries, and defense components — increasing costs but boosting domestic jobs.

D. Currency and commodity fluctuations

Investors brace for rapid swings in the dollar, gold, and material prices.

These geopolitical factors create uncertainty across stocks, commodities, and global investment flows — but also opportunities for strategic positioning.

9. The 2026 Stock Market Outlook: High Risk, High Reward

Markets enter 2026 balancing optimism around AI productivity with fears of slowing consumer strength and geopolitical risk.

Potential market drivers:

-

AI adoption across S&P 500 firms

-

earnings growth in cloud, semiconductor, and cybersecurity sectors

-

weakening retail and consumer discretionary spending

-

interest-rate adjustments

-

M&A activity

-

real estate investment shifts

Sectors poised for strong performance:

-

Technology (AI, chips, cloud)

-

Healthcare

-

Energy infrastructure

-

Defense

-

Cybersecurity

-

Industrial automation

Sectors facing headwinds:

-

Commercial real estate

-

Retail

-

Consumer credit companies

Investors who diversify across tech, infrastructure, and defensive assets are better positioned for 2026’s volatility.

10. How Americans Should Prepare for the 2026 Economy

Survival in the next economic era depends on proactive adaptation, not passive optimism.

1. Build AI literacy — urgently

AI is not optional. Mastering AI tools is the fastest way to increase income, productivity, and employability.

2. Strengthen financial resilience

-

Build emergency savings

-

Reduce high-interest debt

-

Consolidate liabilities where possible

-

Prioritize stable, long-term investments

3. Reassess housing decisions

Homeownership may require:

-

multi-generational planning

-

co-buying arrangements

-

relocation to affordable regions

4. Diversify income streams

New income models include:

-

freelance consulting

-

AI-generated products

-

online education

-

e-commerce automation

-

digital assets

5. Develop future-proof skills

The most valuable skills in 2026:

-

problem-solving

-

creative strategy

-

data interpretation

-

AI workflow design

-

cybersecurity basics

6. Monitor geopolitical and market signals

Volatility creates opportunities for informed individuals.

Conclusion: Adaptation Is the New American Advantage

The U.S. economy entering 2026 is dynamic, unpredictable, and full of divergence. It rewards those who innovate and punishes those who wait. America is not entering a collapse — it is entering a restructuring.

The winners of 2026 will be individuals, families, and businesses who:

-

understand the new economic rules

-

embrace technological transformation

-

manage risk strategically

-

invest wisely

-

prepare early

The future is not determined by economic forecasts.

It is determined by the people who act on them.

Prepare now — or get left behind.

FAQs

1. Will the U.S. economy grow or shrink in 2026?

Moderate growth is expected, but with uneven performance across sectors and regions.

2. Will inflation finally return to pre-2020 levels?

No. Prices may stabilize, but they will remain structurally higher long-term.

3. Are major job losses likely due to AI?

Not mass unemployment — but major task replacement, forcing workers to upskill.

4. Will interest rates drop significantly?

Only modestly. The ultra-low-rate era is over.

5. Is 2026 a good year for investing?

Yes — if investors choose high-growth sectors like AI, defense, cybersecurity, and infrastructure.

6. What is the biggest risk for households in 2026?

High-interest consumer debt combined with stagnant wages.